(Washington, DC) – Fifty-six percent of participants in a national survey by The Senior Citizens League (TSCL) say they pay taxes on their Social Security benefits. “The tax on Social Security income takes new retirees by surprise,” says TSCL Chairman Ed Cates. “This is one retirement expense that must be carefully planned for. The government today taxes the Social Security benefits of a majority of older adults, even people with very modest middle incomes,” he notes.

A growing number of Social Security recipients are affected by the tax, because the income thresholds are fixed, rather than adjusted annually, like income brackets. Because of this, the number of Social Security recipients who are hit by the tax has increased substantially over the years as incomes increased.

Prior to 1984 Social Security benefits weren’t taxed, and when the tax on benefits was first enacted in 1983, Congress sold it to the public saying it affected “high income” beneficiaries. At that time, only 10% of Social Security beneficiaries paid the tax. But during the 2015 tax season, an estimated 56% of Social Security beneficiary households will owe federal income taxes on part of their benefit income according to the Social Security Administration.

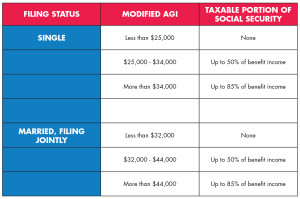

The income thresholds that subject up to 50 percent of Social Security benefits to tax start at provisional incomes of $25,000 (single filers) and $32,000 (joint filers). A second tier taxes up to 85% of benefits when individual provisional income exceeds $34,000, and joint exceeds $44,000. If the thresholds were adjusted to today’s dollars the $25,000 (single) threshold would be about $57,107 and the $32,000 (joint) would be about $73,097 according an analysis for TSCL.

“The tax is a burden for middle class seniors,” Cates says. The Congressional Budget Office estimates that 52 million Social Security beneficiaries paid 6.7% of their Social Security benefits as income tax in 2014 and projects that will rise in the future to 10% or more.

The Senior Citizens League supports legislation The Social Security 2100 Act, H.R. 1391, introduced by Representative John Larson, that would adjust the income thresholds to $50,000 for single filers and $100,000 for joint filers, and replace it with other sources of revenue.

Will you pay taxes on your Social Security benefits this year? Take TSCL’s annual Senior Survey, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.