By Alex Moore

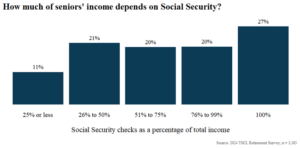

When the Social Security Commissioner Martin O’Malley estimated that the program is “the difference between dignity and poverty” for about half of seniors in a May 2024 press release, he may have needed a fact check. The sentiment was right, but the estimate was low: 67 percent of seniors said they rely on Social Security for more than half their income in TSCL’s 2024 Retirement Survey (Figure 1).

Among the survey’s more than 3,000 respondents, 27 percent said their entire income came from Social Security. An additional 20 percent depended on the program for between 76 percent and 99 percent of their income, while another 20 percent depended on it for between 51 percent and 75 percent of their total earnings.

Even more concerning, most seniors reported spending numbers that suggest their income falls far below the national household median of $80,610 for 2023, as reported by the Census Bureau. In TSCL’s survey, the median senior household estimated that it spent between $24,000 and $48,000 per year on monthly living expenses, which includes both incomes for couples who receive benefits or draw from separate retirement accounts.

Seniors’ dependence on Social Security and its often-meager COLAs means that many find themselves under intense financial stress. In TSCL’s survey, 62 percent reported worrying that their income won’t be enough to cover basic essentials, like rent and food. Even more, 69 percent, said they’re concerned that rising prices will force them to raise their spending and deplete their savings.