For Immediate Release – November 17th, 2025

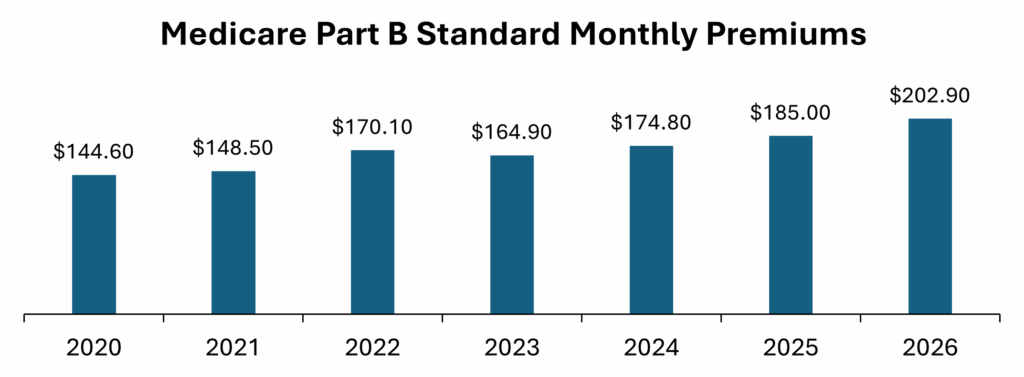

2026 Medicare Part B Premiums Announced at $202.90

This is the third straight year that the Medicare Part B standard premium has risen faster than Social Security’s Cost-of-Living Adjustment (COLA). This year’s premium increase of 9.7 percent was more than three times the 2026 COLA (announced in October) of 2.8 percent. Meanwhile, the 2025 premium increase of 5.8 percent was more than twice the 2025 COLA of 2.5 percent, and 2024’s premium increase of 6 percent was nearly double that of the 2024 COLA of 3.2 percent.

The standard premium is only the floor for Medicare costs. For people who file their taxes as single, the standard premium is only available for those whose modified adjusted gross income is less than $109,000. For people who file as a couple, it is only available for those whose adjusted gross income is less than $218,000. Beneficiaries who earn more, even if they live in high-cost-of-living areas, can expect to pay up to $689.90 a month in 2026, depending on their income.

Key Insights:

- While the government does have some measures in place to protect seniors from their healthcare costs rising faster than Social Security benefits, those measures fall short. Medicare’s “hold harmless” provision limits the rise in Medicare Part B premiums deducted from Social Security benefits to no more than a given year’s COLA, but that means many seniors get their COLAs merely reduced instead of overtaken altogether.

- Newly retired Americans bear the brunt of fast-rising Part B premiums. The “hold harmless” provision does not apply to beneficiaries who are new to Medicare or those whose income is high enough to pay more than the standard premium.

- Congress needs to act to solve this problem, but a solution will be difficult. One option would be to tie Part B premium increases to Social Security’s COLA, which is designed to track inflation. However, if healthcare costs continued rising faster than prices in the economy as a whole, this could lead to Medicare funding issues.

TSCL Executive Director Shannon Benton says…

- “Medicare Part B premiums consistently overtaking Social Security COLAs degrades American seniors’ quality of life over time. Our members constantly tell us that they feel like their benefits aren’t keeping up, and this is a great example of that experience in action.”

- “Especially since the pandemic, rising Part B premiums have been ruining seniors’ finances. The data shows that many older Americans already enjoy a lower standard of living than younger citizens, making a fulfilling retirement feel like a dream that’s further and further away.”

- “It is imperative for Congress to act to stop this trend of Medicare costs, and healthcare costs in general, rising faster than inflation in the broader economy. More preventative care for seniors, better dental and vision and hearing coverage, and more power for Medicare to negotiate prices with pharmaceutical companies and other suppliers are all examples of common-sense policy to reverse this trend over time.”

About TSCL:

The Senior Citizens League (TSCL) is one of the nation’s largest nonpartisan seniors’ groups. Established in 1992 as a special project of The Retired Enlisted Association, our mission is to promote and assist our members and supporters, educate and alert senior citizens about their rights and freedoms as U.S. citizens, and protect and defend the benefits seniors have earned and paid for. TSCL consists of vocally active senior citizens concerned about the protection of their Social Security, Medicare, and veteran or military retiree benefits. To learn more, visit https://seniorsleague.org/about-us/.

Contact Information:

- Shannon Benton, Executive Director: sbenton@tsclhq.org; 703-548-5568

- Alex Moore, Statistician: amoore@tsclhq.org; 571-374-2658