(Washington, DC) – Despite receiving a 2 percent cost-of-living adjustment (COLA) in 2018 — about half of all people age 65 and over report that they received virtually no boost to their net Social Security benefit, after factoring in the deduction for steeply increased Medicare Part B premiums, according to a new survey by The Senior Citizens League. “Nearly 27 million Social Security recipients are going through a third consecutive year of no net increase in Social Security benefits,” says Mary Johnson, Social Security policy analyst for The Senior Citizen League. “Retirees aren’t just trying to live on a ‘fixed income,’ but a shrinking one,” Johnson says.

The Senior Citizens League’s 2018 survey collected information from 1,116 retirees across the nation about the impact of extremely low COLAs, and the Social Security “hold harmless” provision on benefit growth. The hold harmless provision is triggered when the dollar amount of Medicare Part B premium increases more than the dollar amount of an individual’s COLA. The hold harmless provision protects most (but not all) retirees’ net Social Security benefits from being reduced when the dollar amount of an individual’s annual COLA increase is not sufficient to cover the increase in the Medicare Part B premium.

Normally, the provision affects only a tiny number of beneficiaries in any given year, which has a relatively minimal impact on Part B premiums. Since 2010, however, the hold harmless provision has been triggered on a nationwide basis an unprecedented four times. This occurred when inflation was so low that no COLA was payable in 2010, 2011, 2016, and a COLA of just 0.3 percent was paid in 2017.

New research conducted by Johnson for The Senior Citizens League found that, in 2018, the entire COLA was consumed by rising Part B premiums for retirees with a Social Security benefit of as high as $1,288 per month. “That’s just slightly lower than the national ’average’ retiree benefit,” Johnson notes. “After deducting for steeply rising Part B premiums, in 2018, that left little or nothing left over for other rising costs like home heating oil, food costs, especially for fresh fruits and vegetables, and out-of-pocket medical costs,” Johnson says. “This means retirees must spend more from retirement savings, go into debt, or join growing numbers who are turning to safety net programs or going without,” Johnson explains.

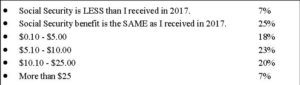

The Senior Citizens League survey asked participants— “Which of the following amounts most closely resembles your monthly Social Security benefit increase this year, AFTER the Social Security Administration’s deduction for the Medicare Part B premium increase?” Here’s the breakdown of how participants answered:

When the hold harmless provision is triggered on a nationwide scale, the entire burden of Part B costs is spread over a much smaller number of individuals — the 30 percent of Medicare Part B enrollees who are not protected by the hold harmless. This has led to significant spikes in Medicare Part B premiums during the hold harmless years, and in 2018 when a COLA finally became payable, to steep jumps in premiums for those whose Medicare Part B premiums were held lower in 2016 and 2017.

According to Johnson, “The triggering of hold harmless will continue in future years on an individual basis, particularly when inflation is lower than 2 percent, or if Medicare Part B premium increases are higher than 5%, or both. Individuals with the lowest benefits, $490 or less, are the most likely to be affected by hold harmless over the next decade. This will occur even in years when a COLA is payable, particularly if Medicare Part B premium increases are higher than expected,” Johnson states.

TSCL supports legislation that would calculate the COLA using an index that’s more representative of retiree spending, the Consumer Price Index for Elderly Consumers (CPI-E). To learn more, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.