The average retiree’s Social Security check just went up to $2,015.07 thanks to the 2026 COLA of 2.8 percent. Social Security retirement benefits averaged $1,960.18 in November 2025, the last month with data available. TSCL estimates the COLA’s average increase for retirees at $54.89.

This marks the first time the average retirement benefit exceeds $2,000. For reference, Zillow reports that the average monthly rent for a one-bedroom apartment in the U.S. is $1,500.

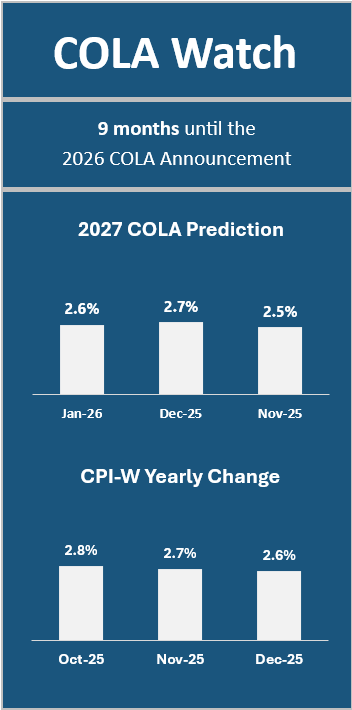

TSCL predicts Social Security’s 2027 COLA will be 2.5 percent. That’s 0.3 percentage points lower than this year’s COLA of 2.8 percent.

Meanwhile, seniors express deep concerns about inflation. TSCL’s 2025 Retirement Survey,with a Census-weighted sample of 1,359 Americans over the age of 65, found that 53 percent of seniors believe their income won’t cover essential goods and services, while 58 percent worry inflation will push them to raise spending and deplete their savings.

- The 2026 COLA is too little, and the average Social Security retirement benefit passed $2,000 is too late. The fact is that TSCL’s research—with samples that are representative of the over-65 population and balanced across political preferences—consistently finds that most seniors believe the COLA falls short more often than not. For example, when we asked seniors to estimate the annual inflation rate from the prior year in our 2025 Senior Survey, 80 percent estimated it was 3 percent or higher. The 2025 COLA was just 2.5 percent.

- Most seniors struggle with financial uncertainty and vulnerability. TSCL’s 2025 Retirement Survey estimates that 28.2 percent of U.S. seniors, or about 15.7 million Americans over the age of 65, do not have enough income to cover essentials such as food, transportation, and housing. Meanwhile, 52.4 percent (or another 29.2 million) can afford to get by for now, but don’t feel confident about their ability to do so in the future.

TSCL Executive Director Shannon Benton says…

Key Insights:

- “Seeing the average Social Security retirement benefit cross $2,000 is a big milestone, but one that we’re witnessing far too late. The reality is that seniors consistently tell us that they see their benefits falling further behind inflation every year, as their quality of life degrades.”

- “According to our research, four in five seniors are either already struggling to pay for basics like rent and food or are living from benefits check to benefits check. Nearly 60 percent have skipped at least one medical service in the last year because they couldn’t afford it. About 20 percent rely on food stamps! As a country, we need to question why we’re letting our elders slip into poverty while we sit and watch, especially when the Social Security Office of the Chief Actuary has already identified several proposals that would change the tax code to strengthen today’s benefits and extend Social Security’s solvency by a generation.”

About TSCL:

The Senior Citizens League (TSCL) is one of the nation’s largest nonpartisan seniors’ groups. Established in 1992 as a special project of The Retired Enlisted Association, our mission is to promote and assist our members and supporters, educate and alert senior citizens about their rights and freedoms as U.S. citizens, and protect and defend the benefits seniors have earned and paid for. TSCL consists of vocally active senior citizens concerned about the protection of their Social Security, Medicare, and veteran or military retiree benefits. To learn more, visit https://seniorsleague.org/about-us/.

About the TSCL COLA Model:

TSCL issues a new prediction of the next COLA for Social Security each month using our statistical model. The model incorporates the Consumer Price Index, the Federal Reserve interest rate, and the national unemployment rate to make its predictions. The model’s predictions update throughout the year, adjusting in response to economic conditions. For additional information about the model, contact Alex Moore, TSCL’s statistician, at amoore@tsclhq.org.

We released a new version of the model, v1.2, in January 2025. The new version updates the model’s use of dates, processing data according to the federal fiscal year instead of the calendar year. The new model also reduces each prediction’s reliance on previous predictions made throughout the federal fiscal year.

Contact Information:

- Shannon Benton, Executive Director: sbenton@tsclhq.org; 703-548-5568

- Alex Moore, Statistician: amoore@tsclhq.org; 571-374-2658