(Washington, DC) – Sixty – six percent of retirees report spending more than $375 a month on healthcare costs according to a recent survey by The Senior Citizens League (TSCL). “That figure is almost one quarter of the average $1,523 per month Social Security benefit in 2020 and more than the Medicare Trustees estimate for 2020,” says Mary Johnson, a Social Security and Medicare policy analyst for The Senior Citizens League. Even worse, of that group, 31 percent of survey participants said they spend more than $1,000 a month on total healthcare costs — roughly two-thirds of the average Social Security benefit.

“These findings are particularly troubling considering that the Government Accountability Office estimated in 2019 that 48 percent of households aged 55 and older have no retirement savings or other form of pension outside of Social Security,” Johnson says. The Centers for Medicare and Medicaid Services recently announced that the standard Medicare Part B for 2021 will be $148.50, an increase of $3.90 per month.

This Part B increase comes at the same time retirees will receive one of the lowest COLAs ever paid, that will increase the average Social Security benefit by only $20.00 per month. Because Medicare Part B premiums and out-of-pocket costs grow several times faster than annual cost of living adjustments (COLAs), healthcare costs take a rapidly growing share of Social Security benefits. The situation can leave older households without adequate income and dwindling savings after just a few years in retirement.

For years, the Medicare Trustees have warned about the problem in their annual report. They’ve estimated that Medicare Part B and Part D premiums, as well as cost sharing for both programs, currently equals just 24 percent of the level of the average Social Security benefit. But the Senior Citizens League’s findings include common retiree healthcare costs not included in the Trustees’ estimate.

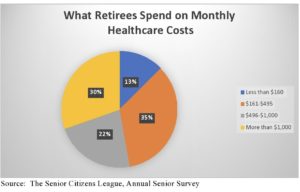

The survey which was conducted online asked how much survey participants spent per month on all healthcare costs. Participants were asked to include premiums for Medicare Part B, Medigap, Part D and Medicare Advantage plans, as well as all out-of-pocket spending on doctor visits and services, co-pays and co-insurance for prescription drugs, dental and optical exams, glasses and hearing aids.

The chart following chart illustrates the percentage of responses for each of five spending points:

Less than $375 — 34% (24 percent of the average $1,523 Social Security benefit.)

$376-$495 — 13%

$496-$750 — 13%

$751-$1,000 — 9%

More than $1,000 -31%

“These findings are a huge red flag that the standard of living of older Americans is eroding, and this is true not only for lower income households, but for all retirees,” says Johnson. To help older households weather the impacts of the coronavirus, and to better afford Medicare Part B premium increases, The Senior Citizens League is supporting the “Emergency Social Security COLA for 2021 Act,” which would replace the 1.3 percent COLA with a more adequate of 3 percent COLA in 2021. For details, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors’ groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.