(Washington, DC) – Low inflation in recent years may be helping younger workers cut costs at the gas pump, but it isn’t translating into lower costs for older and retired Americans, says The Senior Citizens League (TSCL). According to a recent study by TSCL, Social Security beneficiaries have lost 23 percent of their buying power since 2000. And another year of low cost-of-living adjustments (COLAs) is in store for 2017, according to a new TSCL analysis of consumer price index (CPI) data through August 2016.

“Social Security benefits have flat - lined since 2010,” says Mary Johnson, a Social Security policy analyst and author of TSCL’s buying power study. “That was the first time since the annual COLA became automatic that inflation was too low for a COLA to be payable,” Johnson notes. Since then, COLAs have averaged just 1.2 percent per year, less than half the 3 percent that COLAs averaged during the decade prior to 2010.

The lack of growth in Social Security benefits is eroding the buying power of more than 60 million people who depend on Social Security. There was no annual boost again this year. But according to a recent TSCL survey of more than 1,100 people age 62 and over, retiree household expenses continued to climb. Some 72 percent of survey respondents reported their monthly expenses grew by more than $79 in 2015.

Things aren’t likely to improve next year. The Social Security Chief Actuary recently estimated that the COLA in 2017 would be just 0.4 percent, which would be the lowest COLA ever paid. That would raise benefits just $4.00 per $1,000 in benefits.

“That estimate tracks closely with the CPI data through August,” Johnson says. “Overall inflation readings are very low, but that’s almost entirely due to the dramatic drop in oil prices again this year,” she notes. Meanwhile, the data show some big jumps in the cost of goods and services that older and disabled Americans use the most. But that won’t necessarily translate into higher COLAs, because the index used to calculate the annual Social Security boost is based on the spending patterns of younger working adults. Younger people tend to spend less on health care and housing, and more on gasoline and electronics, two categories that have gone down in recent years.

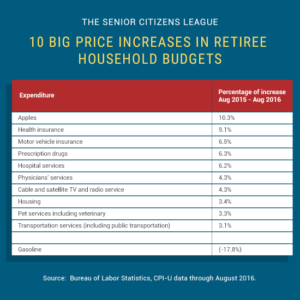

According to consumer price index data through August, ten of the biggest price jumps for Social Security recipients over the past 12 months are illustrated in the following chart:

TSCL is working for legislation that would provide an emergency COLA. The Seniors and Veterans Emergency (SAVE) Benefits Act (S. 2251, H.R. 4144) introduced by Senator Elizabeth Warren (MA) and Representative Tammy Duckworth (IL-8), would provide Social Security beneficiaries with a one-time emergency COLA of 3.9 percent. For the average retiree, the emergency COLA would amount to around $580 dollars. To learn more, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.

ALSO AVAILABLE TO JOURNALISTS: STUDY METHODOLOGY