Washington, DC) – The Medicare Part B premium increase for 2021 may consume a significant portion of the annual Social Security cost-of-living adjustment (COLA) boost for most retirees, warns The Senior Citizens League (TSCL). “This may even be the case despite recent legislation to limit the Part B increase,” says Mary Johnson, a Social Security and Medicare policy analyst for The Senior Citizens League.

The group bases their warning in part on a survey conducted earlier this year when the 1.6 percent Social Security COLA had just gone into effect. The standard Medicare Part B premium increased $9.10 per month from $135.50 in 2019 to $144.60— a 6.7 percent increase in 2020.

Nearly 65 percent of participants in the survey reported that, after deduction of the Part B Medicare premium, their net Social Security benefits increased by only $15 per month or less. Of that group, 5.7 percent said net Social Security benefit did not increase at all. Another 7.5 percent reported that their net Social Security benefit in 2020 was less than it was in 2019 a situation that can affect some higher income retirees.

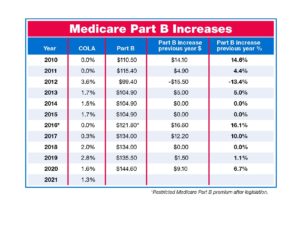

The COLA for 2021 will be even lower — 1.3 percent — meaning there will be even less of a boost to cover the Medicare Part B increase. While the Part B premium for 2021 is expected to be announced in November, Johnson notes that years in which Medicare premiums have increased the most during 2010 through 2020, coincided with years in which beneficiaries received no, or a very low, cost of living adjustment (COLA) as shown in the following table:

The Part B premium is likely to higher than expected, due to the impacts of COVID-19. In its September budget update, the Congressional Budget Office forecast that, due to higher spending for COVID-19, Medicare outlays would grow 12 percent this year — roughly two times faster than the Medicare Trustees forecast in April. That forecast was released prior to when the impacts due to COVID were fully known. Recently passed legislation restricts the increase for 2021 to the 2020 amount plus 25% of the difference between the 2020 amount and a “preliminary amount” for 2021.

While hopeful that the Part B premium increase will be modest, Johnson points to the situation in 2016. “The 16.1 percent Part B increase in 2016 was the ‘restricted’ amount after legislation,” she notes. In 2016, there was no COLA at all, and the preliminary amount that Medicare Part B premium was first forecast to be was $159.30 per month an unprecedented 52 percent higher than the previous year. But legislation lowered that increase to $121.80 and the final amount was 16.1 percent higher.

These Part B premium spikes are associated with the triggering of the Social Security hold harmless provision which protects about 70 percent of beneficiaries from net reductions to their Social Security benefits when the Medicare Part B premium increases more than the dollar amount of their COLA. A protected individual’s Medicare Part B premium increase is reduced so that their net Social Security check won’t be lower from one year to the next. But 30 percent of Medicare beneficiaries are not protected, and these people may be subject to significantly higher premiums.

In essence, there’s a massive cost shift from those who are protected to those who aren’t because current law does not specify how the unpaid portion of Medicare Part B premiums of those who are protected should be financed. Because program costs are spread over a much smaller number of beneficiaries, Medicare Part B premiums are much higher than they otherwise would be. Those who are not protected by hold harmless include:

- Low-income beneficiaries who don’t have Medicare premiums deducted from their Social Security checks. About 20 percent of beneficiaries. These are people whose incomes are so low, that their Medicare Part B premiums are paid on their behalf by their state Medicaid program.

- Higher - income beneficiaries. Roughly 5 percent of Medicare beneficiaries, those who have modified adjusted gross incomes (MAGI) of more than $87,000 (individual filer) or married couples with incomes of $174,000 (joint filers) are required to pay income-related surcharges on their Part B premiums. The law specifically excludes this group from protection under hold harmless. These individuals are required to pay the full amount of any increase in their Part B premiums.

- New enrollees. About 3% of beneficiaries.

- People who have not started Social Security. About 2% of beneficiaries may have delayed signing up for Social Security because they have not reached full retirement age, are still working, or both.

Here’s a hypothetical example of the how hold harmless protection works: A COLA of 1.3 percent would increase a $740 benefit by $9.60 per month. If Medicare Part B were to increase by $10.00 per month, then all those with $740 benefit, and, who are protected by hold harmless, would see their Part B premium reduced to $9.60 to prevent reduction of their net Social Security benefit. In future years, beneficiaries with reduced premiums would pay a little more than others to catch up to the full amount of Medicare premiums, and “That can take several years for those with lowest benefits when COLAs remain low,” Johnson says.

To help older households weather the impacts of the coronavirus and to better afford Medicare Part B premium increases, Senior Citizens League is working for passage of emergency legislation to provide a more adequate COLA of 3 percent in 2021. To learn more, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors’ groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.