For Immediate Release:

February 12, 2024

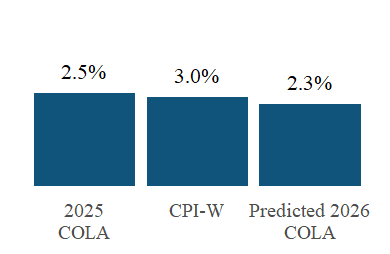

2026 COLA Predicted at 2.3% as

Congress Introduces Bill to Eliminate Social Security Taxes

TSCL’s COLA model predicts that the 2026 COLA will come in at 2.3% for 2026. That is below the 3.0% yearly change in the CPI-W (the index used to calculate the COLA) announced by the Bureau of Labor Statistics this morning. If the prediction holds and inflation drops throughout the year, the 2026 COLA would end up 0.2 percentage points lower than last year’s COLA of 2.5%.

Meanwhile, Congressman Thomas Massey has re-introduced a bill to make good on President Trump’s promise to eliminate income taxes on Social Security benefits. Initially proposed in 2023, the Senior Citizens Tax Elimination Act would substantially reduce many senior citizen’s tax burden.

TSCL estimates that eliminating taxes on Social Security benefits would save the typical senior household about $3,000 annually if implemented in 2025. In our upcoming analysis for the March edition of the monthly Advisor newsletter, we estimate that a typical senior household would pay $3,940 in federal income taxes if Social Security benefits were excluded, compared to an estimated $7,022 under the current law—resulting in a savings of $3,082.

Key Insights:

- Eliminating taxes on Social Security benefits would relieve lagging COLAs.

Estimated savings from the Senior Citizens Tax Elimination Act would make up for about 69 percent of the buying power Social Security payments have lost since 2010 due to inadequate COLAs. TSCL research estimates that the average yearly Social Security benefits for retired workers are worth approximately $4,442 less today than they were in 2010, after adjusting for inflation. - It would also reduce “double taxation” on seniors. Since Social Security beneficiaries have already paid tax on their contributions to Social Security through the payroll tax, they are essentially paying taxes on their benefits twice under current law.

- Even if the law passed, many low-income seniors would still not see the difference. Seniors who earn below certain amounts, in other words, the most vulnerable—already do not pay taxes on their benefits. If it does not pass, the tax thresholds that have not been adjusted for inflation since 1984 will result in more low-income seniors paying taxes as annual COLAs accumulate.

TSCL Executive Director Shannon Benton Says:

- “Eliminating taxes on Social Security benefits would be an excellent step to provide financial relief to American seniors, many of whom are struggling with a cost of living that is growing much faster than their incomes. It would also reduce double taxation, which is inherently unjust.”

- “However, we need to do even more for low-income seniors whose dignity depends on Social Security payments that have already lost 20 percent of their buying power over the last 15 years. Many lower-income seniors already do not make enough to pay taxes on their Social Security benefits, and the only way to help them is by reforming Social Security’s COLAs.”

About the TSCL Model:

Each month, TSCL issues a new prediction of the next COLA for Social Security using our statistical model. The model incorporates the Consumer Price Index, the Federal Reserve interest rate, and the national unemployment rate to make its predictions. The model’s predictions update throughout the year, adjusting in response to economic conditions. For additional information about the model, contact Alex Moore, TSCL’s statistician, at amoore@tsclhq.org.

TSCL released a new version of the model, v1.2, in January 2025. The new version updates the model’s use of dates, processing data according to the federal fiscal year instead of the calendar year. The new model also reduces each prediction’s reliance on previous predictions made throughout the federal fiscal year.

About TSCL:

The Senior Citizen’s League (TSCL) is one of the nation’s largest nonpartisan seniors’ groups. Established in 1992 as a special project of The Retired Enlisted Association, our mission is to promote and assist our members and supporters, educate and alert senior citizens bout their rights and freedoms as U.S. citizens, and protect and defend the benefits seniors have earned and paid for. TSCL consists of vocally active senior citizens concerned about the protection of their Social Security, Medicare, and veteran or military retiree benefits. To learn more, visit https://seniorsleague.org/about-us/.