For Immediate Release – June 11, 2025

2026 COLA Prediction Rises to 2.5% as BLS Faces Challenges With Collecting CPI Data

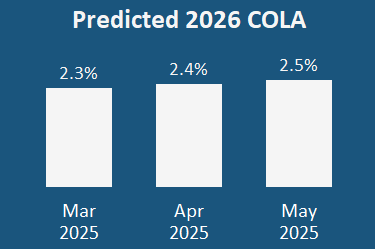

TSCL predicts Social Security’s 2026 COLA will be 2.5 percent, up from last month’s prediction of 2.4 percent. The TSCL model’s prediction has increased for four consecutive months.

Meanwhile, the Bureau of Labor Statistics faces unprecedented challenges collecting data for the price index used to calculate the COLA. According to the Wall Street Journal, a hiring freeze at the agency has forced the Consumer Price Index program to cut back on the number of businesses where it measures prices. In April, the agency said it had used a less accurate method for estimating prices more than usual, due to a shortage of workers, and it has stopped collecting consumer inflation data in three cities.

Problems with CPI data could spell problems for American seniors. Putting less reliable data into the CPI makes it a less reliable measure of inflation, and seniors already have their doubts. According to TSCL’s 2025 Senior Survey, to be released this week, 80 percent of seniors thought 2024’s inflation was over 3 percent, which is higher than this year’s COLA of 2.5 percent.

Key Insights:

- Any erosion in the CPI’s reliability presents big risks to seniors’ livelihoods. If the government fails to act and the CPI’s data quality begins to erode, it increases the likelihood of the government providing a COLA that doesn’t match inflation. While there’s a chance that any miss could be higher than actual inflation, it’s just as likely that a miss would be low. A COLA that comes in under inflation would set seniors back for the rest of their retirement, as Social Security checks compound over time with each additional COLA.

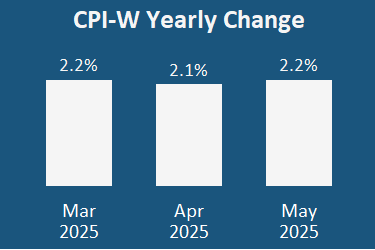

- An erosion in the CPI’s data could also affect future COLA and inflation predictions. The CPI for Urban Wage Earners (CPI-W) is an important input for TSCL’s COLA model. Any reduction in the data’s quality or reliability could introduce new uncertainty to the TSCL model and any other economic models that make use of the dataset. Models like these affect key policy that affects everyday Americans, such as the Federal Reserve interest rate.

TSCL Executive Director Shannon Benton says…

- “While streamlining the federal government is a good thing, that shouldn’t involve cutting back on our ability to measure how our economy is changing. Inaccurate or unreliable data in the CPI dramatically increases the likelihood that seniors receive a COLA that’s lower than actual inflation, which can cost seniors thousands of dollars over the course of their retirement.”

- “Seniors should be concerned as inflation continues to tick upward. TSCL’s research shows that there’s a serious disconnect between the inflation the government reports and the inflation that seniors experience every day. If the government tells us that prices are rising faster, it’s likely that seniors are already feeling the crunch.”

About TSCL:

The Senior Citizens League (TSCL) is one of the nation’s largest nonpartisan seniors’ groups. Established in 1992 as a special project of The Retired Enlisted Association, our mission is to promote and assist our members and supporters, educate and alert senior citizens about their rights and freedoms as U.S. citizens, and protect and defend the benefits seniors have earned and paid for. TSCL consists of vocally active senior citizens concerned about the protection of their Social Security, Medicare, and veteran or military retiree benefits. To learn more, visit https://seniorsleague.org/about-us/.

About the TSCL COLA Model:

TSCL issues a new prediction of the next COLA for Social Security each month using our statistical model. The model incorporates the Consumer Price Index, the Federal Reserve interest rate, and the national unemployment rate to make its predictions. The model’s predictions update throughout the year, adjusting in response to economic conditions. For additional information about the model, contact Alex Moore, TSCL’s statistician, at amoore@tsclhq.org.

We released a new version of the model, v1.2, in January 2025. The new version updates the model’s use of dates, processing data according to the federal fiscal year instead of the calendar year. The new model also reduces each prediction’s reliance on previous predictions made throughout the federal fiscal year.

Contact Information:

- Shannon Benton, Executive Director: sbenton@tsclhq.org; 703-548-5568

- Alex Moore, Statistician: amoore@tsclhq.org; 571-374-2658