The Rising Cost of Unauthorized Work To Social Security:

Growth of the Social Security Earnings Suspense File

Points To Substantial Long-Term Social Security Costs

By Mary Johnson, Social Security and Medicare Policy Analyst

for The Senior Citizens League, April 2016

Summary

Changes in U.S. immigration policy have significant consequences for federal benefit programs, including Social Security and Medicare. In recent years Congress has considered immigration legislation that would affect an estimated 11 million[i] undocumented immigrants living and working in this country without authorization. The Supreme Court is expected to make a decision by June of 2016 on whether to uphold President Obama’s announced series of executive actions affecting an estimated 5 million such immigrants.[ii]

The outcome of these immigration changes could also have significant consequences for all people who rely on Social Security and Medicare. Changes to federal immigration policy affect revenues that Social Security and Medicare receive, and would also increase the number of people eligible for benefits in the future.[iii] Both programs currently face significant solvency and funding challenges. According to national surveys[iv], concern is high among many Americans that undocumented immigrants who worked under fraudulent Social Security numbers may at some point receive benefits based on such work.

Highlights:

- Current policy benefits undocumented immigrants who have committed document fraud by using stolen, fraudulent, or invalid Social Security numbers (SSNs) to work. Rather than penalizing individuals for the use of fake or invalid SSNs, the Social Security Administration (SSA) uses all reported earnings from covered employment when determining entitlement and benefits—even when earnings are from unauthorized work under fraudulent SSNs.[v]

- Citizenship is not a requirement to claim Social Security benefits.[vi] Undocumented immigrants who receive work authorization at some point, also receive a valid SSN, and may claim benefits.[vii] Undocumented immigrants who obtain even temporary work authorization and legal status — whether under administrative immigration rule changes like Obama’s executive action, or major legislation — may eventually claim Social Security benefits if other qualifications are met.

- Although law forbids work without authorization, immigrants use invalid SSNs to get jobs. Most noncitizens living and working in the U.S. are subject to taxation,[viii] including Social Security and Medicare payroll taxes that employers withhold from pay. When employers provide W2s in which the name and SSN do not match those in the SSA’s records, the wage report is held in the Earnings Suspense File (ESF) until the discrepancy can be corrected.

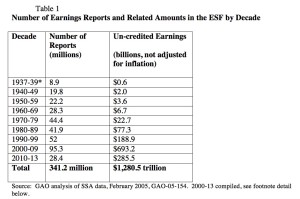

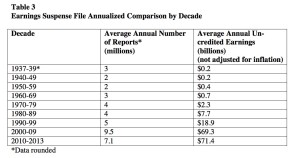

- Data indicate that, since 2000, the ESF grew at an unprecedented pace. Since 2000 SSA has received, on average, 8.8 million suspicious wage reports annually. Cumulative wages since 1980 now total more than $1.2 trillion, unadjusted for inflation. Some experts say that undocumented workers will not benefit from unauthorized earnings because of the challenge of providing evidence of earnings under invalid SSNs. This ignores the effect of immigration policy changes. With widespread work authorization, a significant portion of these wages could later be reinstated to valid SSNs, if undocumented immigrants have kept copies of their W2s or other evidence of earnings to support their claim.

- Because earnings are used to determine entitlement, the portion of earnings from jobs worked prior to legal authorization poses a substantial long-term liability to the Social Security Trust Fund that worsens solvency. It’s widely anticipated that Congress may cut Social Security benefits, perhaps significantly, at some point in the relatively near future. This policy that “pays benefits based on illegal work” raises questions as to whether individuals who worked without authorization and committed document fraud will benefit at the expense of others who paid in under valid SSNs.

Immigration Policy Changes Affect The Financing Of Social Security and Medicare

Changes in U.S. immigration policy can affect revenues that Social Security and Medicare receive, and also would increase the number of people eligible for benefits in the future.[ix] Both programs currently face significant solvency and funding challenges.

Recent immigration proposals in Congress would provide work authorization, as well as valid Social Security numbers (SSNs), to an estimated 11 million immigrants who are living and working in this country without legal authorization.[x] In November of 2014, President Obama also announced a series of executive actions that would defer deportation and offer work authorization and valid SSNs to about 5 million undocumented immigrants.[xi] The president’s plan has been the center of a major court battle which will be decided by the U.S. Supreme Court by June 2016.

A key issue is whether undocumented immigrants, who illegally worked using invalid or fake SSNs prior to gaining work authorization, would be able to claim work credits towards Social Security and Medicare benefits for those earnings. Work authorization, not citizenship, is the key requirement for noncitizens to become entitled to Social Security benefits and Medicare when other program qualifications are met.[xii] Even “limited” immigration changes that provide only permission to work in this country, or temporary work authorization, could potentially add millions of new claims in the future. Under current law Social Security benefits are based on all earnings, including earnings from jobs worked without authorization under invalid and fraudulent documents.

The 2004 Social Security Protection Act (P.L. 108-203) requires immigrants to have work authorization at some point, in order to become entitled to Social Security benefits.[xiii] When determining entitlement for insured status, and in calculating the initial retirement benefit amount, the Social Security Administration (SSA) uses all reported earnings from covered employment in the United States, even when the earnings are from unauthorized jobs worked using invalid, fraudulent or stolen SSNs. In addition, the 2004 law does not apply to immigrants who received SSNs prior to January 1, 2004. That category of immigrant does not need work authorization in order to file a claim for benefits.[xiv]

False SSNs Wind Up In Social Security’s Earnings Suspense File

Although immigration law forbids work without authorization, undocumented immigrants use illegally obtained SSNs, invalid and fake SSNs, and SSNs from temporary visas that have expired, to get jobs. Employers withhold payroll taxes and report earnings to the Social Security Administration. False and invalid SSNs are supplied to employers with no serious or immediate consequence for doing so. Under current law, employers are not required to use the government’s E-Verify system to check the validity of the SSNs provided.

Unauthorized immigrants work using numbers belonging to other people, children, and the dead[xv]. They also use numbers that have been made up, expired work visas, or “non-work” SSNs such as individual taxpayer identification numbers (ITINs), which look similar to SSNs but do not provide work authorization.[xvi] The Social Security Administration processes more than 250 million wage reports from employers annually.[xvii] When Social Security receives a name or SSN on a W-2 that does not match the agency’s records, the wage report goes into the Earnings Suspense File (ESF) while attempts are made to reconcile the discrepancy.

The Office of the Actuary says that changes that Social Security has made since 2001 made it more difficult for unauthorized immigrants to obtain SSNs in their own names through illegitimate means.[xviii] However, the Office of the Actuary estimates that for immigrants entering the U.S. in 2001 or earlier, one-third attained apparent legitimate SSNs through illegitimate means. The Actuary estimated that 2.7 million immigrants have such SSNs in their name and “thus can work, pay taxes, and have earnings credited to their record for potential benefits in the future.”[xix]

The Social Security Office of the Actuary reports that, “Increasingly in the future, earnings reported to SSA for unauthorized workers will be reported with an illegitimate SSN (one that was not issued by SSA for the individual). In this case, the reported earnings show up with a mismatch between name and SSN and thus would be assigned to the Earnings Suspense File.”[xx]

Unauthorized Immigrants And Employers Pay Social Security And Medicare Taxes

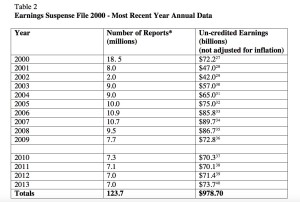

No actual accounting of the amount of money paid into the Social Security system by unauthorized immigrant workers has ever been established. In 2005, Social Security’s Chief Actuary, Stephen C. Goss, was quoted in the news media estimating that about three-quarters of “other–than–legal” immigrants pay payroll taxes. [xxi] In an April 2013 actuarial note, the Social Security Office of the Actuary estimates that unauthorized immigrant workers and their employers paid as much as $13 billion in payroll taxes in 2010.[xxii] In a 2015 interview, Goss estimated that immigrants in the U.S. illegally have paid an estimated $100 billion in Social Security payroll taxes over the past decade.[xxiii] The 2015 estimate appears to be based on the wages represented by $743.8 billion in wage reports submitted from 2003-2012 (see Table 2). Social Security and Medicare payroll taxes of 15.3% based on $743.8 billion would total about $113.8 billion.

Even more problematic is the high level of uncertainty over the number of undocumented workers who could claim credit toward benefits for earnings under false SSNs. In order to do so, claimants would need both work authorization and evidence of earnings under the false SSNs, such as W2s, and copies of tax returns.

Immigration advocates say that while the payroll taxes of unauthorized workers boost Social Security and Medicare financing, the vast majority of undocumented workers will never benefit. The Social Security Office of the Actuary says that, “individuals who currently have authorization to work but did not have authorization while residing here in the past would find it difficult to document the earlier earnings.”

The actual impact, though, is difficult to ascertain. Large numbers of undocumented workers haven’t received work authorization and, because most tend to be younger healthy adults, aren’t old enough to file a claim for retirement benefits. The federal government does collect information that could potentially be used to provide evidence of earnings. The application for employment authorization (green cards), form I-765, asks for a Social Security Number, stating, “Include all numbers you have ever used, if any.” Supplying previously used SSNs presents little risk, and would provide valuable evidence of taxes paid and earnings for entitlement to future benefits.[xxiv]

The IRS could also be a source of documents to be used as evidence. The IRS assigns Individual Taxpayer Identification Numbers (ITINs) to taxpayers and their dependents who are not eligible for Social Security numbers, including undocumented immigrants. Taxpayers can request copies of past tax returns that may contain information about earnings, and the ITIN, if it was used to work, instead of a SSN.

The Potential Cost of Benefits Based on Unauthorized Work is Growing, But Specifics Are Not Known

Social Security benefits are not calculated based upon the taxes paid in, but rather upon the individual’s earnings. Under Social Security’s progressive benefit formula, retired workers with lower earnings receive a bigger portion of their earnings in benefits than people with higher earnings. While the payroll tax rate is 15.3% of earnings, the estimated benefit replacement rate for a 30-year old worker in 2014, for example, varies from 19.3% of earnings for workers with high career-average earnings of $72,138 to as much as 43.3% of earnings for workers with very low career-average incomes of $11,271.

Due to the high level of uncertainty, the Social Security Office of the Actuary appears to be unable to estimate the potential long-term cost of Social Security benefits based on unauthorized earnings. The Office of the Actuary states that “because we cannot identify which individual ‘wage items’ are for unauthorized immigrants and which are for legal residents, we have no way to determine specifically either the number of wage items reported per worker or the average annual earnings per worker represented on the ESF. Historically, both the unauthorized population and the percent of total reported earnings that goes to the ESF have been rising and we estimate a continuation of these trends. ”[xxv]

The data since 2000 indicate that there has been a significant jump in both the number of these mismatched reports and the value of wages reported. From 2000 – 2009, the total number of mismatched wage reports almost doubled, jumping from about 52 million reported from 1990 – 1999, to 95.3 million from 2000 – 2009. The number of mismatched wage reports received annually peaked in 2006 at 10.9 million, averaging 9.5 million per year during the period. From 2010 – 2013 the average number of wage reports received annually dropped, averaging 7.1 million, corresponding with high unemployment rates during the period (for details see Table 2).

Cumulative wages since 1980 now total more than $1.2 trillion unadjusted for inflation. The amount of average annual wages represented by the reports has also grown considerably from 2000 —through 2013 after adjusting for inflation. In 2000 wages averaged $5,370 per work report compared to an average of $10,710 in 2013 (adjusted to 2016 dollars). The higher wages suggest a more experienced and older work force, implying that unauthorized workers may be living and working in the U.S. for longer periods and not returning home.

According to a report by the Pew Research Center’s Hispanic Trends Project, the median length of time that unauthorized immigrants have lived in the U.S. is nearly 13 years.[xxvi] To qualify for Social Security retirement benefits, individuals need about ten years of work. Depending on age, individuals may qualify for Social Security disability benefits with fewer years of earnings.

Fraudulent Use of Social Security Numbers is Not Penalized Under Current Law

Mismatched earnings reports remain in the ESF until the Social Security Administration obtains evidence to link the unidentified earnings to a valid work authorized SSN — a process termed “earnings reinstatement.”[1] Reinstatements can occur any time, even years later when a claim is filed. The Social Security Administration’s Office of Inspector General recently reported that as of October 2014, the SSA had reinstated from the ESF at least 171 million W-2s spanning 1937 to 2013.[2]

Immigration reform and executive action initiatives that provide work authorization and a valid SSN, together with a pending Social Security totalization agreement with Mexico (if it takes effect), could mean that a very substantial amount of earnings in the ESF file could be claimed and reinstated at some point in the future. Based on more than $1.2 trillion in wages since 1980, and the number of wage reports held by the ESF, the potential benefit costs appear significant, and would worsen program solvency in the future.

Once undocumented workers obtain legal work -authorized SSNs, individuals can file a claim for benefits when other qualifications are met. No law prohibits the Social Security Administration from using unauthorized earnings in determining entitlement to Social Security, even when fraudulent documents were used to get jobs. Individuals who can provide evidence of earnings, like W2s from unauthorized employment prior to receiving their SSN, can have earnings reinstated under their valid SSN.

Older Americans Believe That Determining Benefits Based on Work Under False SSNs Should Be Prohibited

While the payroll taxes of undocumented immigrants boost Social Security and Medicare financing, surveys by The Senior Citizens League (TSCL) show that there’s little public support, especially among adults 65 and over, for allowing the use of unauthorized earnings under false SSNs to determine entitlement and benefits. Wide majorities of older voters believe that Congress should prohibit payment of Social Security benefits that are calculated on unauthorized earnings by undocumented immigrants. According to a survey conducted by The Senior Citizens League in 2015, 82 percent of poll respondents say they support such measures.

TSCL believes that with such large and undetermined potential costs, Congress should strengthen Social Security by enacting legislation to prohibit the use of unauthorized earnings from being counted toward eligibility for Social Security benefits. TSCL believes the legislative changes should be made regardless of whether Congress moves on immigration or Social Security reform. Doing so would protect program funding from the costs of unauthorized employment.

The Senior Citizens League

Protecting and Defending Benefits for Older Americans

1001 North Fairfax St, #101, Alexandria VA 22314,

800-333-TSCL

[1] “Better Coordination Among Federal Agencies Could Reduce Unidentified Earnings Reports,” GAO, February 2005, GAO-05-154, page 1.

[2] Status of the Social Security Administration’s Earnings Suspense File, Social Security Administration Office of the Inspector General, September 2015, A-03-15-50058.

[i] “How Changes In Immigration Policy Might Affect The Federal Budget,” Congressional Budget Office, January 2015, http://www.cbo.gov/publication/49868 .

[ii]Fact Sheet: Immigration Accountability Executive Action, White House, November 20, 2014,

http://www.whitehouse.gov/the-press-office/2014/11/20/fact-sheet-immigration-accountability-executive-action . “Supreme Court To Review Obama’s Power on Deportation, Barnes and Ellperin, The Washington Post, January 19, 2016.

[iii] “How Changes In Immigration Policy Might Affect The Federal Budget,” Congressional Budget Office, January 2015, http://www.cbo.gov/publication/49868 .

[iv] 2015 Senior Survey, The Senior Citizens League.

[v] Statement of the Honorable Patrick P. O’Carroll, Inspector General, Social Security Administration Before the Subcommittee on Social Security of the House Committee on Ways and Means, March 02, 2006.

[vi] “How Changes in Immigration Policy Might Affect The Federal Budget,” Congressional Budget Office, January 2015, http://www.cbo.gov/publication/49868 .

[vii] “Social Security Benefits For Noncitizens,” Congressional Research Service, July 20, 2006, RL32004.

[viii] “How Changes in Immigration Policy Might Affect The Federal Budget,” Congressional Budget Office, January 2015, http://www.cbo.gov/publication/49868 .

[ix] “How Changes in Immigration Policy Might Affect The Federal Budget,” Congressional Budget Office, January 2015, http://www.cbo.gov/publication/49868 .

[x] “How Changes in Immigration Policy Might Affect The Federal Budget,” Congressional Budget Office,January 2015, http://www.cbo.gov/publication/49868 .

[xi] Fact Sheet: Immigration Accountability Executive Action, White House, November 20, 2014,

[xii] “How Changes in Immigration Policy Might Affect The Federal Budget,” Congressional Budget Office, January 2015, http://www.cbo.gov/publication/49868 .

[xiii] “Social Security Benefits For Noncitizens,” Congressional Research Service, February 2, 2010, RL32004.

[xiv] Ibid.

[xv] Audit Report: “Number holders Age 112 or Older Who Did Not Have a Death Entry On The Numident,” Office Of The Inspector General Social Security Administration, March 2015, A-06-14-34030, http://oig.ssa.gov/sites/default/files/audit/full/pdf/A-06-14-34030_0.pdf .

[xvi] Status of the Social Security Administration’s Earnings Suspense File, Social Security Administration Office of the Inspector General, September 2015, A-03-15-50058.

[xvii] Ibid.

[xviii] Actuarial Note Number 151: “Effects Of Unauthorized Immigration On The Actuarial Status Of The Social Security Trust Funds,” Social Security Administration Office of the Chief Actuary, April 2013, http://www.socialsecurity.gov/oact/NOTES/pdf_notes/note151.pdf .

[xix] Ibid.

[xx] Ibid.

[xxi] “Illegal Immigrants Are Bolstering Social Security With Billions,” Eduardo Porter, The New York Times, April 5, 2005.

[xxii] Actuarial Note Number 151: “Effects Of Unauthorized Immigration On The Actuarial Status Of The Social Security Trust Funds,” Social Security Administration Office of the Chief Actuary, April 2013, http://www.socialsecurity.gov/oact/NOTES/pdf_notes/note151.pdf.

[xxiii] “Republicans: Obama Giving ‘Amnesty Bonuses’ To Immigrants,” Stephen Ohlemacher, Associated Press, February 24, 2015, http://www.pbs.org/newshour/rundown/republicans-obama-giving-amnesty-bonuses-immigrants/.

[xxiv] I-765, Application for Employment Authorization, U.S. Citizenship and Immigration Services, February 27, 2015, http://www.uscis.gov/i-765.

[xxv] Actuarial Note Number 151: “Effects Of Unauthorized Immigration On The Actuarial Status Of The Social Security Trust Funds,” Social Security Administration Office of the Chief Actuary, April 2013, http://www.socialsecurity.gov/oact/NOTES/pdf_notes/note151.pdf.

[xxvi] “As Growth Stalls, Unauthorized Immigrant Population Becomes More Settled, Pew Research Hispanic Trends Project, September 3, 2014, http://www.pewhispanic.org/2014/09/03/as-growth-stalls-unauthorized-immigrant-population-becomes-more-settled/.