By Daisy Brown, Legislative Liaison

A bill proposed in Congress this January, the You Earned It, You Keep It Act, would save the typical senior hundreds of dollars per year by eliminating all taxes on Social Security income starting in 2025. Additionally, the bill would protect benefits for current and future generations by extending Social Security’s solvency by 20 years, according to an estimate from the Social Security Administration’s (SSA’s) Chief Actuary.

Impact on Today’s Seniors

Under current policy, 50 percent of Social Security income is taxable for seniors who earn more than $25,000 per year if they file an individual tax return, or $32,000 per year for married couples who file a joint tax return. For single filers who earn at least $34,000 and joint filers who earn at least $44,000, that number can rise as high as 85 percent.

The You Earned It, You Keep It Act would eliminate that tax burden altogether, and the impact on seniors’ lives would be substantial.

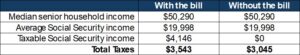

TSCL estimates that if the bill had been implemented in 2022, the last year with available Census Bureau data on seniors’ incomes, it would have saved the typical senior household $497.52 for the year. As shown in the table below, the median senior household earned $50,290 that year, with an average of nearly $20,000 coming from Social Security. Of that Social Security income, $4,146 would have been taxable without the bill, compared to $0 with the bill.

You Earned It, You Keep It Estimated Impact for 2022

Adjusting the numbers for inflation, TSCL estimates that the bill would have saved the typical senior household nearly $560 per year if it had been implemented in 2024.

While these numbers might not seem massive, they can quickly add up. The typical retirement lasts 18 years, according to the Census Bureau, which means that the bill could easily add $10,000 to the typical senior household’s income total throughout their golden years.

Impact on Future Seniors

The You Earned It, You Keep It Act funds its increased benefits for seniors by increasing Social Security taxes on top earners. Under the bill, people would have to pay the 6.2 percent payroll tax on their first $250,000 of wages, compared to their first $168,600 today.

The bill’s impact on the country’s financial health would be substantial. In addition to extending the solvency of Social Security by 20 years, from 2034 to 2054, it would reduce the federal deficit by an estimated $8.9 trillion over the next 75 years, according to the SSA’s Chief Actuary. In other words, the bill not only benefits the seniors of today, but ensures that more seniors of tomorrow will receive their fair share, too.

TSCL believes that the You Earn It, You Keep It Act is a good deal for seniors. If you agree, let your congressperson know by signing our petition at this link:

https://seniorsleague.salsalabs.org/StopTaxingSocialSecurity/index.html