By Alex Moore

Social Security’s Cost-of-Living Adjustment (COLA) for this year was 3.2 percent, which is higher than the 2.6 percent average inflation we’ve seen over the last 20 years. According to the most recent data from TSCL’s Senior Survey, 69 percent of seniors saw their household expenses rise by more than the COLA over the past year, with costs for food and housing leading the way.

As a result, some seniors turned to dire measures to keep afloat. Among more than 1,550 seniors who participated in the Senior Survey, about half said their financial situation forced them to dip into emergency savings or carry credit card debt for more than three months during the last year. Perhaps even more concerning, a third of seniors said they had to visit a food pantry or apply for SNAP benefits, or food stamps, to put dinner on the table, and nearly a quarter said they had depleted a retirement or savings account to zero.

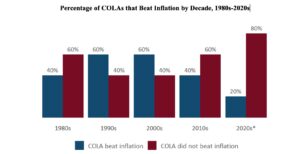

A major driver behind seniors’ financial struggles is the failure of Social Security payments to keep up with inflation over the long term. COLAs fell behind inflation much more often in the 2010s and the 2020s so far compared to the 1990s and 2000s, according to data from the Social Security Administration and the Consumer Price Index (CPI).

So, what can we do to reverse this trend? A majority of seniors support three key changes to mitigate the impact of inadequate COLAs.

Remove the Wage Limit for Social Security Contributions

Under current law, working Americans pay a 6.2 percent payroll tax into Social Security. That is, until their income reaches $168,600. After that, they don’t pay any taxes toward Social Security on any additional money they earn as income. This means that as top earners make more, they pay a lower percentage of their wages into the program.

Senior citizens resoundingly support changing this law. More than three in four participants in the Senior Survey (78 percent) said the payroll tax should be applied to all wages, removing the $168,600 threshold.

Apply 6.2% Social Security Tax to Net Investment Income

Another opportunity to increase Social Security’s revenue to fund more robust COLAs is applying the 6.2 percent tax that funds the program to investment income for high earners. Currently, money people make from selling stocks and collecting dividends is not taxed toward Social Security. To make things worse for retirees, seniors whose income rises because they cash in their investments can see the amount of taxes they pay on their Social Security benefits go up.

A popular way to address this issue would be applying the 6.2 percent Social Security payroll tax to investment income for taxpayers with income greater than $200,000 for individual filers or $250,000 for joint filers. About three in five participants in the Senior Survey supported this change.

Adjust Taxation Threshold on Social Security Benefit

The third major policy that most seniors support to address the gap between COLAs and inflation is fixing how Social Security benefits are taxed. Today, seniors who are single filers start paying taxes on their benefits when they make $25,000 or more. Joint filers start paying taxes on their benefits once they make $32,000 or more. These thresholds have never been adjusted for inflation since they became effective in 1983, more than 40 years ago.

More than half of participants in the Senior Survey (57 percent) said these thresholds need to be changed, and that’s despite nearly a third being unsure of whether or not they’d support the policy—potentially because it’s a complex change. More specifically, they want to see the current income thresholds for taxing benefits adjusted to today’s dollars, which would be $74,614 for single filers and $93,600 for joint filers.