For Immediate Release:

January 15, 2025

2026 COLA Prediction Update

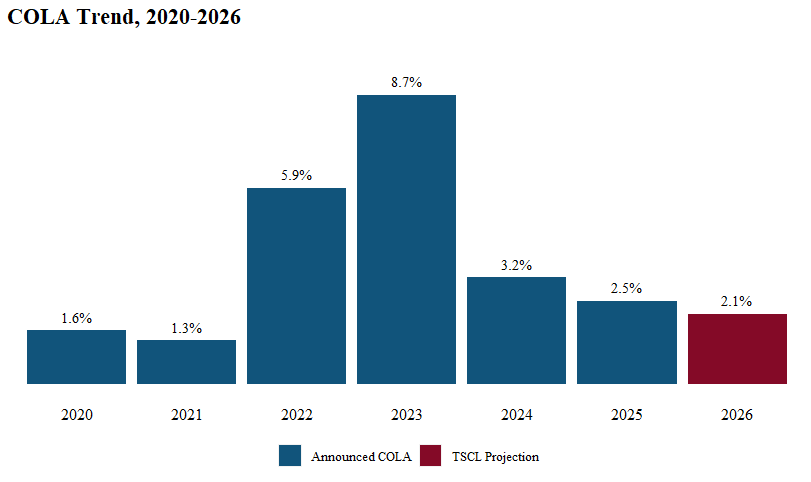

TSCL’s COLA model predicts that the 2026 COLA will come in at 2.1% for 2026. Based on this morning’s announcement from the Bureau of Labor Statistics, the CPI-W (the index used to calculate the COLA) came in at 2.8% in December 2024.

In other words, cooling inflation could lead to the lowest COLA since the start of the COVID-19 pandemic. As shown in the chart below, 2025’s COLA was a meager 2.5 percent, down from 3.2 percent in 2024 and a whopping 8.7 percent in 2023. The last time the COLA came in below 2.0 percent was 2021, when it was 1.3 percent.

If SSA announced the 2026 COLA today, using data from October to December instead of July to September, it would come in at 2.6%. This downward trend for COLAs comes amid a period of serious financial struggle for American seniors: TSCL survey data suggest that 67 percent of seniors depend on Social Security for more than half their income.

Key Insights:

- Slowing COLAs risk leaving seniors behind. While slowing inflation is a good thing, it doesn’t mean prices will fall—just that they’ll rise more slowly. This leaves many seniors facing a budget shortfall. According to data from TSCL’s 2024 Senior Survey, 62 percent of older Americans worry that their retirement income won’t even cover essentials like groceries and medical bills.

- The incoming administration can support seniors by following through on its plan to eliminate taxes on Social Security Benefits. TSCL estimates that this plan could save a typical senior about $3,000 a year, which comes out to about 5 percent of a typical senior budget.

TSCL Executive Director Shannon Benton Says:

- “Inflation slowing down doesn’t mean that seniors are catching up. It’s essential that Congress acts quickly to fix years of sub-par COLAs and help give seniors the quality of life they deserve.”

- “The Trump Administration’s plan to eliminate taxes on Social Security benefits would make a massive difference. The current thresholds used to determine if you’ll pay taxes on your benefits were set up back in the 1980s, and we’ve never adjusted them for inflation.”

About the TSCL COLA Model:

Each month, TSCL issues a new prediction of the next COLA for Social Security using our statistical model. The model incorporates the Consumer Price Index, the Federal Reserve interest rate, and the national unemployment rate. The model’s predictions update throughout the year, adjusting in response to economic conditions. For additional information about the model, contact Alex Moore, TSCL’s statistician, at amoore@tsclhq.org.

We released a new version of the model, v1.2, in January 2025. The new version updates the model’s use of dates, processing data according to the federal fiscal year instead of the calendar year. The new model also reduces each prediction’s reliance on previous predictions made throughout the federal fiscal year.

About TSCL:

The Senior Citizen’s League (TSCL) is one of the nation’s largest nonpartisan seniors’ groups. Established in 1992 as a special project of The Retired Enlisted Association, our mission is to promote and assist our members and supporters, educate and alert senior citizens about their rights and freedoms as U.S. citizens, and protect and defend the benefits seniors have earned and paid for. TSCL consists of vocally active senior citizens concerned about the protection of their Social Security, Medicare, and veteran or military retiree benefits. To learn more, visit https://seniorsleague.org/about-us/