For Immediate Release – March 12, 2025

Expected 2026 COLA at 2.2% as SSA prepares to claw back Social Security overpayments.

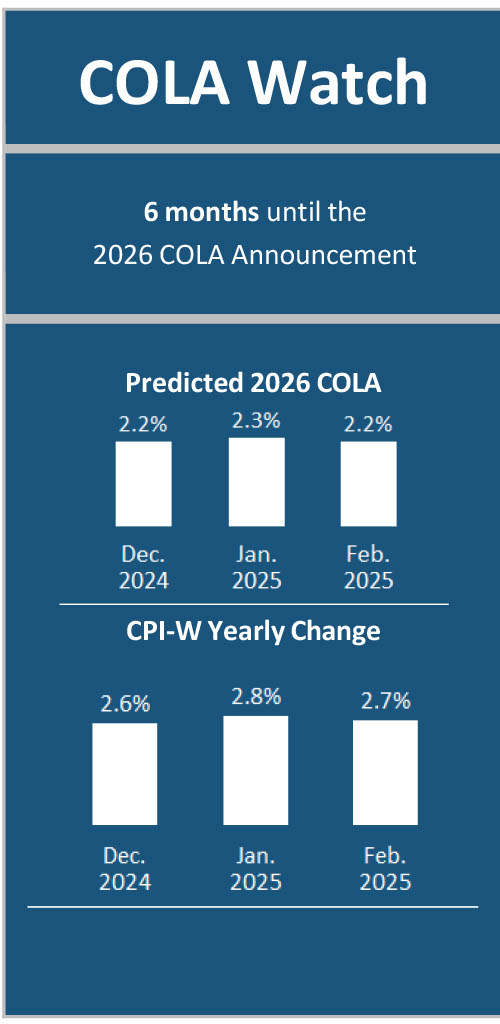

TSCL’s COLA model predicts that the 2026 COLA will come in at 2.2 percent after the Bureau of Labor Statistics announced the CPI-W decreased to 2.7 percent for February from 3.0 percent last month. TSCL’s most recent prediction is 0.3 percentage points higher than last year’s COLA of 2.5 percent.

Meanwhile, the Trump administration announced a new policy to ratchet up SSA’s efforts to collect overpaid Social Security benefits. Starting on March 27th, seniors receiving accidental overpayments will have 100 percent of their future benefits withheld until they’ve paid back all taxpayer money. This rule, which reverses a Biden-era policy that withheld the greater of 10 percent or $10, will only take effect on overpayments that occur after March 27th.

According to its Agency Financial Reports, the SSA collected an average of $4.2 billion in overpayments per year from fiscal years 2017 to 2023. Meanwhile, it ran an average balance of $22.8 billion in uncollected overpayments during the same period.

Key Insights:

The government could send seniors a check worth an expected $495 if it recovered its entire overpaid benefits balance in a typical year, according to a TSCL analysis. After that, suppose the government continued paying back recovered overpayments as a dividend to retirees. In that case, we’d then expect it to be able to increase seniors’ benefits by an average of $77 in a typical year.

This would be a strong tool to make up for a lower COLA than seniors are hoping for. If we calculated the 2026 COLA today, using the last three months of CPI-W data, it would come in at 2.8 percent. That’s 1.1 percentage points below the average COLA of the 2020s so far, 3.9 percent.

However, the government should consider giving seniors more time to return overpaid benefits before it starts withholding Social Security checks. Social Security beneficiaries currently have 30 days from being notified of being overpaid to return the funds before the government begins withholding benefits. The Social Security Overpayment Act, which was introduced in the previous Congress but failed to pass, would extend this window to 120 days and provide valuable relief for seniors.

TSCL Executive Director Shannon Benton says…

“While The Senior Citizen’s League (TSCL) believes overpayments on Social Security benefits should be recouped, we feel it’s important that beneficiaries not face undue pressure from an immediate 100 percent reduction in benefits.”

“The Senior Citizens League (TSCL) supported the Social Security Overpayment Act in the previous Congress. Had it passed, the bill would have extended the time for the SSA to begin withholding benefits from 30 days to 120 days after notifying a beneficiary of an overpayment.

“The clawback of payments is especially unfair to seniors who do not have external support to help manage their finances and track their benefits. Many beneficiaries may not be aware of an overpayment and could suddenly find themselves without a check. The time between notification and recoupment should be extended, and we hope that some members of Congress will have the courage to reintroduce the Social Security Overpayment Fairness Act.”

About TSCL:

The Senior Citizen’s League (TSCL) is one of the nation’s largest nonpartisan seniors’ groups. Established in 1992 as a special project of The Retired Enlisted Association, our mission is to promote and assist our members and supporters, educate and alert senior citizens about their rights and freedoms as U.S. citizens, and protect and defend the benefits seniors have earned and paid for. TSCL consists of vocally active senior citizens concerned about the protection of their Social Security, Medicare, and veteran or military retiree benefits. To learn more, visit https://seniorsleague.org/about-us/.

About the TSCL COLA Model:

TSCL issues a new prediction of the next COLA for Social Security each month using our statistical model. The model incorporates the Consumer Price Index, the Federal Reserve interest rate, and the national unemployment rate to make its predictions. The model’s predictions update throughout the year, adjusting in response to economic conditions. For additional information about the model, contact Alex Moore, TSCL’s statistician, at amoore@tsclhq.org.

We released a new version of the model, v1.2, in January 2025. The new version updates the model’s use of dates, processing data according to the federal fiscal year instead of the calendar year. The new model also reduces each prediction’s reliance on previous predictions made throughout the federal fiscal year.

Contact Information:

- Shannon Benton, Executive Director: sbenton@tsclhq.org; 703-548-5568

- Alex Moore, Statistician: amoore@tsclhq.org; 571-374-2658