By Alex Moore

The average American spends approximately $1,080 per year on subscriptions, with around $200 allocated to subscriptions that they don’t even use. That’s according to the 2nd Annual Subscription Survey, a survey research project by online tech publication CNET that was released in June 2025. And since these numbers are only averages, the reality is that they’re much higher for some individuals. It’s quite possible to spend $1,000 or more on unwanted subscriptions.

Conducting a thorough review of your financial accounts can help you keep your spending on subscriptions within your budget. You might be surprised by how much waste it prevents.

To get started, here are steps you can take to audit your subscriptions.

Choose Between a Premium Service and the Traditional Route

Here’s some good news. You don’t have to do your subscription audit on your own if you don’t want to. Many tools and apps, including Rocket Money, DoNotPay, and TrueBill, will review your bank accounts and identify, or even cancel, unwanted subscriptions for you. But here’s the bad news: Most of these tools require yet another subscription.

Doing the work yourself can be time-consuming, but luckily, it isn’t too challenging for people who are not in complex financial situations. If you want to take the traditional route, you’ll need to have your bank account information and a tracking tool, such as an Excel spreadsheet or a Word document, handy.

Search for Transactions Within the Last Year

To audit your spending on subscriptions, you’ll want to go through the records of every one of your bank accounts. Don’t forget to include your credit cards and any accounts that you rarely use. Hidden subscriptions might be lurking there, too.

You’ll want to go back through your records for the last 12 months on each account. That’s because while many subscriptions are billed monthly, others are billed annually when they renew. For example, some Amazon Prime users pay $139 per year rather than $14.99 per month. Look for regular charges around the same day every month when hunting for monthly subscriptions, then odd, one-off charges to service providers when searching for yearly ones.

Whenever you find a subscription, record it in your Excel sheet and Word document. Write down:

- A clear name for the subscription.

- How much and how often it’s billed.

- The website of the company you pay.

Look for the Top Culprits

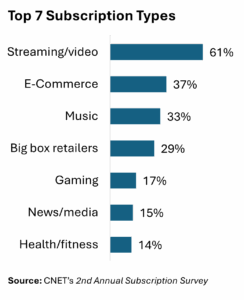

Although subscriptions can take many forms, it’s probably best to start your audit with the services that people most often subscribe to. According to CNET’s report, as shown in the chart below, the most common type of subscription is for a streaming service, like Netflix. Following that are e-commerce, music, big-box retailers, gaming, news and media, and health and fitness subscriptions.

When you’re reviewing your bank statements and building out your list of subscriptions, make sure to pay close attention to any charges from companies associated with any of the top subscription areas. Also, look out for non-digital subscriptions, like gym fees and magazines.

Review Your Findings and Start Cancelling

Once you’ve finished compiling your list of subscriptions, you can start making decisions. Using the list you’ve constructed, add up the total annual cost of all your subscriptions. For a visual representation, you can categorize them by type and put them on a graph.

Next, ensure that you highlight or note any subscriptions you don’t use. If you’re using Excel, it’s great to do this in a new column. Also, mark subscriptions that you underuse, as well as ones for which you think you could find a cheaper alternative. Then, start cancelling. If you don’t use a subscription or don’t need it, contact the provider and insist on cancelling. If you underuse it or could find it cheaper, consider the impact on your budget and any trade-offs with your quality of life or wellbeing. For example, don’t cancel your Life Alert subscription just because you haven’t had to use it yet.

Lastly, be sure to review the cancellation terms for any subscription you terminate carefully. If you ever need a subscription again, cancelling it prematurely could lead to new fees when you sign back up or force you to lose access to a promotional rate.