Q: How would cost of living adjustments be affected if Congress used the Consumer Price Index for the Elderly instead of the one currently used?

A: One of TSCL’s top legislative priorities is to work with Congress to enact legislation that provides better protection from inflation for Social Security benefits. To do so, TSCL proposes three provisions to help ensure more adequate Social Security buying power protection.

1. Provide a modest 2% benefits boost for all retirees — an extra $37 per month or about ($444) per year on average — to help make up for recent spikes of inflation that caused benefits to fall behind the actual rates of inflation in 2021 and 2022.

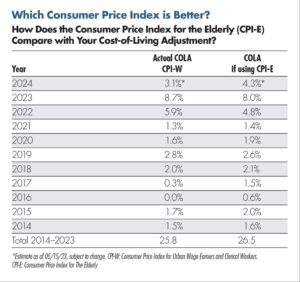

2. Tie the annual inflation adjustment to a “seniors’ consumer price index such as the Consumer Price Index for the Elderly (CPI-E) instead of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). In the past, the difference between these two tended to be about 0.25 percentage point, but that difference, as modest as it is, has declined over the past decade. The CPI-W yields a higher cost of living adjustment (COLA) when gas and oil prices climb because it gives greater weight or importance to oil prices. Conversely, when gas and oil prices decline, the CPI-E tends to be higher because it gives greater weight to housing and prescription drugs. That said, the CPI-E would have yielded a higher COLA than the CPI-W in 7 out of the past ten years, as the table below illustrates. On the other hand, Social Security recipients received a better COLA under the current CPI-W in 2022 and 2023 due to the record-setting price increases in oil and gasoline prices.

3. Guarantee that the COLA cannot be less than 3%. This provision is vital, particularly since our U.S. Federal Reserve sometimes must “target” inflation to bring the inflation rate to more manageable levels. Should inflation fall below 3%, it would impact the 2024 COLA.

The following table illustrates the differences between what Social Security beneficiaries received using the CPI-W versus what they would have received if the CPI-E were used to calculate the annual adjustment.