Let’s Be Real: — The Social Security COLA Is Meager, Even When “Above Average”

Edward Cates, Chairman of the Board, TSCL

Inflation data is slowing down to more typical rates of growth, but so far NOBODY is throwing any parties yet. The overall rate of inflation announced in October was 3.7% higher than one year ago. But even though the rate of inflation has come down, prices are still higher than one year ago and retirement incomes aren’t keeping up.

High prices continue to cause financial turmoil for almost all consumers, despite some economists saying that the buying power of Americans is improving. Is this really the case?

Recently, Mark Zandi, the chief economist for Moody’s Analytics weighed in saying on social media (https://twitter.com/Markzandi/status/1689626766875254786) that “To be sure, the high inflation of the past 2 + years has done lots of economic damage. Due to the high inflation, the typical household spent $202 more in a July than they did a year ago to buy the same goods and services. And they spent $709 more than they did 2 years ago.”

The real rate of inflation experienced by retired and disabled households is higher than our COLA measures. That’s due in part to the consumer price index used to calculate the annual inflation adjustment. COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This consumer price index measures inflation in the goods and services purchased by younger working adults.

Oddly, the CPI-W does not measure the price change of households who are disabled or retired and not working, over the age of 62 — in other words the majority of those who receive Social Security benefits. But older and disabled consumers spend their household budgets differently than younger workers. Seniors spend a bigger portion of their budget on housing, healthcare, and food. Younger workers spend a bigger portion of their budget on transportation and energy costs. When the index fails to account for the portion of income spent on big categories such as housing and healthcare, Social Security recipients get shortchanged on their COLAs.

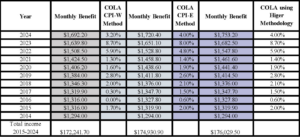

When the COLA first became an automatic annual adjustment in 1975, the CPI-W was the only index. But today there are several consumer price indexes including a “senior CPI,” the Consumer Price Index for the Elderly (CPI-E). If the CPI-E were used to calculate the COLA, it would provide a modestly higher COLA in most, but not every year. This was especially the case in 2021 and 2022 when gasoline prices drove up the CPI-W affecting the COLAs paid in 2022 and 2023. Here’s how the indexes compare today and what the COLA would have been if Social Security beneficiaries received the higher of the CPI-W or the CPI-E.

How Much More Would Social Security Recipients Receive If Paid The Higher of

the CPI-W or CPI-E?

Source: The Senior Citizens League

CPI-W: Consumer Price Index for Urban Wage Earners and Clerical Workers

CPI-E: Consumer Price Index for The Elderly

Recently Representative John Larson (CT) re-introduced The Social Security 2100 Act. The most recent version of the bill contains a provision that would provide better inflation protection. Previous versions of the bill called for tying the COLA adjustment to the CPI-E, but to ensure added protection in years when oil and energy prices are driving inflation, the latest version of the bill would require use of the HIGHER of the CPI-E or the CPI-W.