By Edward Cates, Chairman, TSCL

This October, the Social Security Administration announced that the 2025 COLA, implemented this month, would be 2.5 percent. This increase is the average yearly inflation for the third quarter of 2024 (August to October) for the Consumer Price Index for Urban Wage Earners (CPI-W).

This COLA is far too low. Seniors know that it hasn’t kept up with rising prices for essentials like food and groceries, let alone big-ticket items like housing and transportation. It’s emblematic of the government’s failure to secure our dignity and wellbeing.

However, there’s a simple solution that would improve the situation: Use a price index other than the CPI-W that better reflects seniors’ budgets. And luckily, such a price index already exists. The Consumer Price Index for the Elderly (CPI-E) is custom-made to track the inflation experienced by older Americans, and the government simply doesn’t use it to calculate the COLA.

For 2025 alone, the COLA would be 3 percent using the CPI-E instead of CPI-W’s 2.5 percent, which would have meant that the average Social Security payment for retired workers would have increased by $58 instead of the $48 we actually received. While this difference may seem small, it would make a massive difference over time.

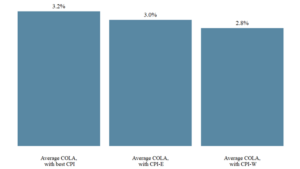

Look at the chart on the next page. Since 2015, the CPI-E has averaged 3 percent, compared to 2.8 percent for the CPI-W. If we assume that trend was to continue over the next 10 years, starting from 2024’s average payment for retired workers of $1,924, retirees’ cumulative payments would increase by more than $3,000 using the CPI-E to calculate the COLA instead of the CPI-W.

The difference is even more pronounced if we go one step further and use the better of the CPI-E and CPI-W to calculate the COLA. From 2015 to 2025, a COLA that used this methodology would have averaged 3.2 percent. Again, if we assume this trend continues over the next 10 years, starting from 2024’s average payment for retired workers of $1,924, retirees’ cumulative payments would be more than $6,000 higher.

These figures alone are enough to make a compelling case to switch the COLA to the CPI-E or begin using the better of the CPI-E or CPI-W to calculate the COLA each year. A difference of several thousand dollars over a decade is the difference between seniors being able to afford a down payment for a new vehicle, an expensive medical procedure, or just enough groceries to get by every month.

That said, at TSCL, we believe that changing the COLA calculation should only be the starting point of Social Security reform. We know that seniors demand a minimum COLA of 3 percent, with higher increases in years with higher inflation. We also know that seniors want to see fiscal reforms that will fund the program not through just their retirements, but their grandchildren’s retirements.

That’s why we’ll never stop fighting for you. American seniors deserve better, and it’s our mission to ensure that better happens.

That’s why I encourage you to take our 2025 Senior Survey. There’s more information at the end of the newsletter, but this research project will create a free, data-driven report that we can use to let decision makers know where seniors stand. Click here to take it now.

Figure 1: Average COLA from 2015-2025 by Calculation Method