(Washington, DC) – Eighty - five percent of retirees think Congress should modify Social Security to provide a higher annual cost-of-living adjustment (COLA), and they support very gradually raising payroll taxes to pay for it, according to a new survey by The Senior Citizens League (TSCL). “Older Americans feel the COLA does not adequately protect their Social Security benefits from rising costs, and a large majority want Congress to strengthen the COLA and Social Security’s financing, says Mary Johnson, a Social Security and Medicare policy analyst for The Senior Citizens League.

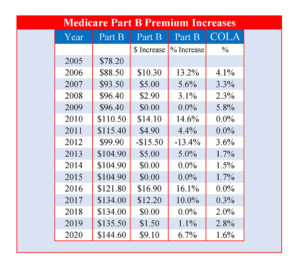

COLAs have been at unprecedented lows for more than a decade, averaging just 1.4 percent annually. There was no COLA paid at all in 2010, 2011, and 2016, and only 0.3 percent paid in 2017. In contrast, COLAs averaged 3 percent per year from 1999 to 2009 — more than twice the average over the past 11 years. At the same time that COLAs have been at record lows, Medicare Part B premiums have grown nearly three times as fast. Since 2010, COLAs grew by a total of 15.2 percentage points, while Medicare Part B premiums increased by 44.5 percentage points.

When asked how Congress should modify the COLA, The Senior Citizens League’s survey found 38 percent of participants support tying the annual inflation boost to a “senior CPI,” the Consumer Price Index for the Elderly (CPI-E), which tends to grow .25 percentage point more rapidly than the current CPI. Forty-seven percent support providing a minimum COLA guarantee — of no less than 3 percent.

In 2020, Social Security recipients receive a COLA increase of 1.6 percent, raising the average $1,500 retirement benefit by about $24 per month. A COLA based on the CPI-E, however, would have paid 1.9 percent, and that would raise the average benefit by about $28.50 per month in 2020. A 3 percent minimum would raise average benefits by $45 per month. The difference in the COLA can seem quite small at first but, when compounded over time, a more adequate COLA provides more income when retirees are the oldest and more likely to have spent down retirement savings.

When costs during retirement grow faster than the COLA, that erodes buying power and Social Security benefits are worth less over time,” says Johnson. Research by Johnson has found that Social Security benefits have lost about one third of their buying power since 2000.

The Senior Citizens League supports legislation that would provide a modest boost in Social Security benefits and strengthen Social Security financing. To learn more, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors’ groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.