By Mary Johnson, editor

Raise your hand if you’ve ever wondered how much higher your Social Security benefits would be if your benefits were tied to the percentage of increase in Medicare Part B premiums, instead of the consumer price index. That was the first thing I wanted to know when the 14.5% Medicare Part B premium increase was announced last fall.

I sat down and ran the numbers. It’s a lot more. A whole lot. If the annual Social Security cost-of-living adjustment (COLA) were tied to the percentage of increase in Medicare Part B premiums, benefits over the past decade would be 42 percent higher in 2022! Our COLA is shortchanging us and failing the very people it’s supposed to protect.

Medicare Part B premiums are the fastest-growing cost that most older Americans face in retirement, but those costs aren’t fairly accounted for by the method used to adjust Social Security benefits for inflation. This is a major source of erosion in the buying power of Social Security benefits.

If the Social Security COLA equaled the percentage increase in Medicare Part B, from 2013 to 2022, a benefit of $1,155 would be about $593 per month higher in 2022 (that would be $7,116 more in 2022.). Had the COLA equaled the increase in Part B premiums, retirees with an average benefit of $1,115 per month in 2012 would have pocketed an extra $32,608 from 2013 through 2022!

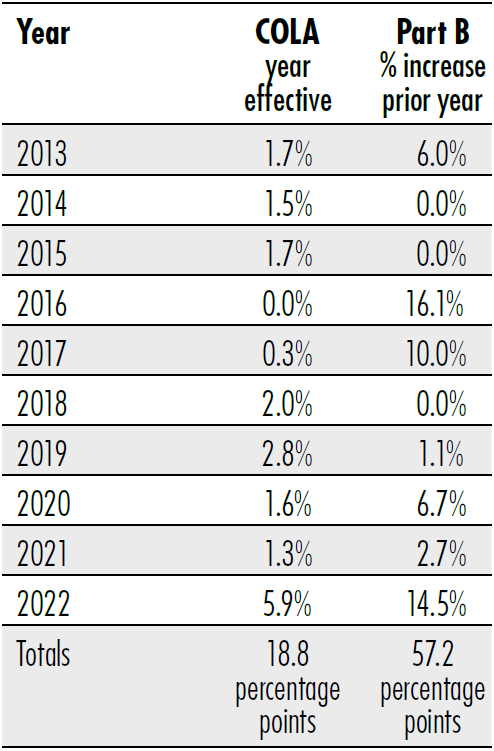

As high as the 2022 Part B premium increase is, Medicare premiums routinely have increased about three times faster than COLAs over the past decade. From 2013 to 2022, the COLA increased benefits by 18.8 percentage points while Medicare premiums grew by 57.2 percentage points as illustrated in the following chart.

Medicare Premiums Increased Three Times Faster Than COLAs Over Past Decade

The Social Security COLA is provided to protect the buying power of Social Security benefits, but the COLA doesn’t account for Part B premiums. The annual inflation adjustment is based on the price changes of goods and services used by working adults younger than age 62 and doesn’t include price changes experienced by retired and disabled Americans over that age who receive Medicare.

Social Security benefits have lost 32 percent of their buying power over the past 21 years, and that loss has deepened as inflation has continued to rise in 2022. The Senior Citizens League continues to work for passage of a one-time $1,400 stimulus check for Social Security recipients and has collected 100,000 signatures from its online petition. For details, visit www.SeniorsLeague.org.