Washington, DC) – A 14.5 percent jump in the Medicare Part B premiums for 2022 spells trouble ahead for beneficiaries wondering where the money will come from to pay all the bills, warns The Senior Citizens League (TSCL). “The Part B increase from $148.50 to $170.10 per month is the highest since 2016 and will consume the entire annual cost of living adjustment (COLA) of Social Security recipients with the very lowest benefits, of about $365 per month,” says Mary Johnson, a Social Security and Medicare policy analyst for The Senior Citizens League. “Social Security recipients with higher benefits should be able to cover the $21.60 per month increase, but they may not wind up with as much left over as they were counting on,” Johnson says.

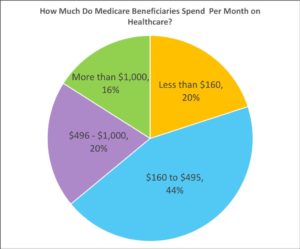

While the 5.9 percent COLA is the highest increase in 4 decades, Medicare Part B premiums grow even faster percentage wise almost every year, far outpacing the rate of growth in the COLA. A new survey by The Senior Citizens League found that 44 percent of Medicare recipients report spending from $160- $495 a month on healthcare costs. “That’s significant portion of income to spend on medical expenses, considering that the average monthly Social Security benefit (including retirees, disabled and survivors) is about $1,487,” “These findings are particularly troubling because about 46 percent of our survey participants also report that they have no retirement savings to fall back on,” Johnson says.

Johnson has found that rising Part B premiums have ranked as one of the fastest growing costs that older Americans face in retirement, increasing 274 percent since 2000.

Because Medicare Part B premiums are automatically deducted from Social Security benefits, they consume a growing share of Social Security and other retirement income over the course of a retirement. This often leaves those retired the longest, along with households without adequate savings, in a real bind.

Medicare Trustees have warned about this problem in their recent annual report. They estimated that Medicare Part B and Part D premiums, as well as cost sharing for both programs, currently equals about 23 percent of the average Social Security benefit. “But that estimate does not include a number of the most common healthcare costs that many Medicare recipients pay,” Johnson says.

The Senior Citizens League’s survey, which was conducted online and had over 1200 participants, asked how much survey participants spent per month on all healthcare costs. Participants were asked to include premiums for Medicare Part B, Medigap, Part D and Medicare Advantage plans, as well as all out-of-pocket spending on doctor visits and services, co-pays and co-insurance for prescription drugs, dental and optical exams, glasses and hearing aids.

The chart following chart illustrates the percentage of responses for each of five spending points:

One effective way to lower healthcare costs for 2022 is to compare health and drug plan options during the Medicare Open Enrollment period going on now through December 7th. Free one - on - one counseling is available in every area of the country through State Health Insurance Assistance Programs. The programs are often run by Area Agencies on Aging.

In addition, the Senior Citizens League recently contacted almost every Member of Congress asking for support of a $1,400 emergency stimulus for Social Security recipients. “We have received dozens of emails from people concerned that their 5.9 percent COLA will cause their income adjusted benefits, such as Medicare Savings Programs and Extra Help, to be trimmed if their incomes increase above program limits,” Johnson says. A $1,400 stimulus check would not be counted as taxable income and could help those Social Security recipients better afford their prescription drugs and co-pays, and enable them to get medical services such as dental care, not covered by Medicare. For details, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors’ groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.