More than two-thirds of older adults participating in TSCL’s latest Retirement Survey say their monthly budget for essential items such as housing, food, and prescription drugs was 10 percent higher than in the fall of 2022. This occurred at the same time the rate of inflation in 2023 was slowing.

Even though inflation as measured by the same index that’s used to calculate the cost-of-living adjustment was 3% in November 2023, prices remained high for some of the biggest-ticket budget items of older households. Housing, motor vehicle insurance, the cost of hospitals, and care of invalids at home — these are the savings-draining black holes even when inflation is low. Yet these are among the very categories seeing the most persistent and painful inflation in recent months.

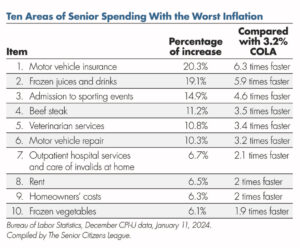

The following list illustrates ten categories with the highest inflation that seniors are trying to cope with at the start of 2024.

The rate of inflation is still coming down, but will persistently high prices come down? We expect some costs, such as housing and care of elderly at home to remain elevated for 2024. TSCL is continuing to monitor persistent high prices, and we invite you to help us do so by taking our 2024 Senior Survey online at SeniorsLeague.org/2024-senior-survey. Tell us, what are your biggest cost challenges in 2024?