By Edward Cates, Chairman, TSCL

According to a new study published by TSCL this June, 21.8 million seniors, or approximately 39 percent of the 55.8 million seniors counted in the 2020 Census, depend on Social Security for their entire income. It also found that 63 percent of seniors rely on their benefits for more than half of their income.

Titled the 2025 Senior Survey, the report is available for free here. It features responses from more than 1,900 American seniors.

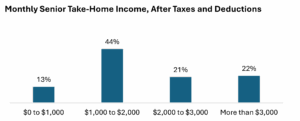

Most Seniors Are Just Scraping By

According to the 2025 Senior Survey, the median American senior lives on a budget of between $1,000 and $2,000 per month. That’s not very much. Consider that the national average cost to rent a one-bedroom apartment was $1,327 as of this July, according to Zillow. If you’re renting, that’s already more than half your income out the door. You’d have less than $700 left for food, gas, clothes, social activities, and emergencies. If you happen to rent in a major urban area with higher rents, that figure is probably optimistic.

Even more concerning, the research estimates that 7.3 million seniors, or about 13 percent of American seniors counted in the 2020 Census, survive on less than $1,000 per month. That’s less than $12,000 per year in total income, which is solidly below the 2025 federal poverty line of $15,650.

Female seniors have it particularly tough. About 66 percent of senior women get by on less than $2,000 a month, compared to just 45 percent of senior men. This finding is statistically significant, which means that there’s almost no chance that such a large difference between men and women appearing in the survey would occur without being true for the U.S. senior population as a whole.

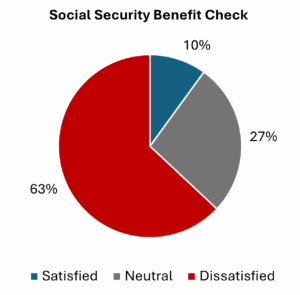

Social Security Isn’t Keeping Up

When the survey asked seniors how they felt about their Social Security benefits, they weren’t happy. Far from it. As shown in the chart below, a mere 10 percent were satisfied with the amount they received in their monthly checks, while 63 percent were dissatisfied.

So, what’s driving this dissatisfaction? It’s inadequate Cost-of-Living Adjustments, or COLAs. An incredible 94 percent of respondents said that this year’s COLA of 2.5 percent was too low and that their benefits would fall behind inflation. In fact, most thought the last COLA was far below inflation. When asked to estimate U.S. inflation for 2024 (which is what the government used to determine the 2025 COLA) based on their economic experience, roughly 80 percent said they thought inflation was 3 percent or higher. That means around four out of every five seniors believe the government’s inflation numbers are too low.

American Seniors Are Calling for Change

When asked how important Social Security and Medicare reform should be for the President and Congress, seniors didn’t equivocate. More than half, or 59 percent, said that reform should be a top priority, and another 34 percent said it should be a high priority. If you’re keeping score, that means more than 9 in 10 seniors want to see the government focused on taking care of their needs.

Seniors are calling for a new inflation index to calculate Social Security’s COLAs. When asked what policies they’d support to raise future COLAs, 68 percent called for calculating COLAs with an inflation index that better represents their economic experiences.

Luckily, as many Advisor readers will already know, such an index already exists. It’s called the Consumer Price Index for the Elderly, or CPI-E. It generally comes in slightly above the CPI-W, which is the inflation index the government currently uses to calculate COLAs and is based on the budget of someone who works in a city, decidedly not the average American retiree.

So, what can you do about it? First, I encourage you to download your free copy of the 2025 Senior Survey at this link. Then, please read it and share it. The more awareness we can raise around the challenges facing seniors today, the more momentum we can build to realize the change we’re fighting for.