By Alex Moore

According to the 2020 Decennial Census, the government estimated that the U.S. population includes about 55.8 million seniors. A new study from TSCL, the 2025 Senior Survey, estimates that 39 percent of them depend on their Social Security benefits for 100 percent of their monthly income. That means Social Security is the only thing keeping about 21.8 million American seniors afloat.

Unfortunately, afloat is far from thriving. The study, which surveyed 1,920 American seniors and used demographic data to match the sample’s representation to the U.S. senior population for more accurate estimates, found that more than half of seniors (57 percent) get by on $2,000 a month or less. Even worse, 13 percent get by on less than $1,000 a month. For reference, the average rent for a 1-bedroom apartment in the U.S. was $1,327 in May 2025, according to Zillow.

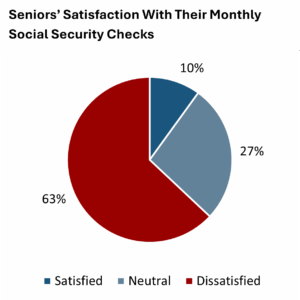

It’s perhaps unsurprising, then, that seniors expressed frustration with their benefits. In total, 63 percent said they were dissatisfied with the amount they received in their monthly Social Security checks. Meanwhile, only 10 percent said they were satisfied.

The COLA for 2025, which came in at 2.5 percent to raise benefits to match inflation that occurred in 2024, was a major point of contention. A whopping 94 percent of seniors said they felt the last COLA was too low, and their benefits would grow more slowly than inflation, and 80 percent estimated the inflation they experienced in 2024 at 3 percent or higher.

“The data in this study shows what seniors have been telling TSCL for years: Social Security checks aren’t keeping up with inflation,” said TSCL Executive Director Shannon Benton. “If four in five seniors think inflation was higher than the government estimate, maybe we should stop questioning their experiences and start questioning why the COLA is failing to measure them.”

In the survey, seniors called on the government to prioritize benefit reform. Nearly all, 95 percent, said that Social Security and Medicare should be a top priority for the presidential administration and Congress. The top individual reform, favored by 68 percent of respondents, was eliminating the limit on how much income is subject to Social Security payroll taxes. Americans don’t pay taxes for Social Security on any income above $176,100 in 2025. According to Benton, the threshold is “currently just a loophole that lets wealthy Americans pay less than their fair share into Social Security.”