Washington, DC) – A one – time emergency 3 percent Social Security cost of living adjustment (COLA) would increase a $1,523 Social Security benefit by about $398 per year on average, over the course of a 25 year retirement period, according to new analysis from The Senior Citizens League (TSCL). “Replacing the announced 1.3 percent COLA with an emergency 3 percent increase is a way to provide a more fair and adequate inflation adjustment to beneficiaries,” says Mary Johnson, Social Security and Medicare policy analyst for The Senior Citizens League. “Because retirees tend to use their Social Security benefits to pay for essentials such as housing and healthcare, it would be a way to help stimulate the economy and to put younger adults back to work, which in turn, means stronger funding for Social Security and Medicare as well,” says Johnson.

Getting the annual inflation adjustment so that it accurately reflects the spending patterns of retired adults is a critical part of Social Security income over the course of a retirement. When inflation adjustments don’t adequately keep pace with rising costs, the Social Security benefits of retirees don’t buy as much over time. Research by Johnson has found that Social Security benefits have lost 30 percent of buying power since 2000. “A basket of groceries that cost $70 in 2000 would cost $100 today,” Johnson says.

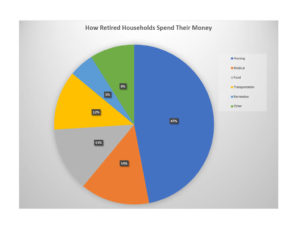

A key issue is the market basket that the government uses to calculate the inflation adjustment for retirees. “That index, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), does not measure the spending patterns of retired adults age 62 and older,” Johnson says. The CPI-W assumes that younger working adults tend to spend about 40 percent of their income on housing and only 7.5 percent of their income on medical care. However, Johnson’s research indicates that retirees tend to spend 47 percent of their income on housing and 14 percent on medical care, both of which have increased faster than the overall rates of inflation in recent years. In addition, the CPI-W doesn’t reflect Medicare Part B premiums, which have grown roughly three times faster than COLAs from 2010 to 2021.

“The Federal Reserve doesn’t expect that inflation will be much more than 1.37 percent for much of the next decade,” Johnson notes. “If you can’t get comfortable on a 1.3 percent Social Security COLA, then it’s time to get involved,” Johnson says. “Ask Congress for a COLA that will protect your Social Security buying power,” says Johnson. The Senior Citizens League is urging the passage of legislation to replace the 1.3 percent COLA with a 3 percent emergency COLA in 2021.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors’ groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.