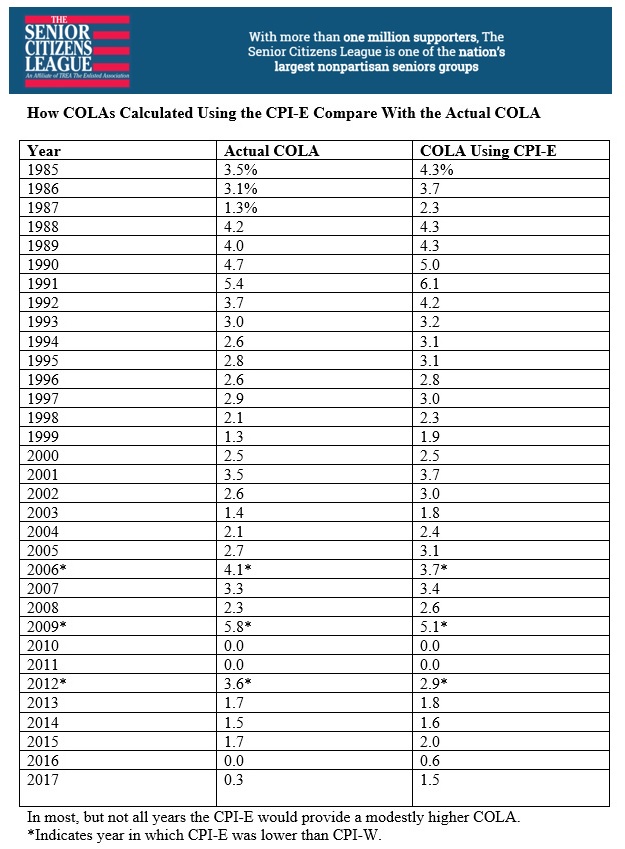

(Washington, DC) – Social Security recipients would get a cost-of-living- adjustment (COLA) that’s seven times higher this year if the annual boost were tied to the rise in the “seniors’” consumer price index, according to a new analysis by The Senior Citizens League (TSCL). Recent data from the U.S. Bureau of Labor statistics confirms that had the government used the Consumer Price Index for the Elderly (CPI-E) to calculate the annual cost – of – living adjustment (COLA) for 2017 instead of the index currently used, Social Security benefits would be 2.1% higher this year instead of the tiny 0.3% that is being paid. “That means that retirees with average benefits would be getting a boost of about $28 or $29 per month instead of $4 or $5,” says TSCL Social Security policy analyst Mary Johnson.

After getting no COLA at all in 2016, Social Security beneficiaries got a small cost – of – living adjustment COLA this year of 0.3%, the lowest ever paid. But few beneficiaries will see any difference. Rising Medicare costs, which are automatically deducted from the benefits of most people, completely offset the tiny increase.

Under current law, the annual boost in benefits, which is provided to keep up with inflation, is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). That index measures cost changes in items typically used by younger working adults. It gives greater weight to costs like like gasoline, which has gone down in price in recent years, but doesn’t give as much weight to medical costs and housing which have been rising rapidly and form a bigger share of spending for people age 62 and over. “The difference between the CPI-E and the CPI-W is at its highest level since the experimental CPI-E was started in 1984,” Johnson explains. “That difference is driven by steeply rising medical and housing costs which aren’t reflected in the COLA that older Americans get,” she says.

The 2.1% increase in the CPI-E is the combined rise in that index since the last time a COLA was payable in 2014. “But according to CPI-E data, the seniors’ index would have paid a COLA of 0.6% last year, when beneficiaries got nothing at all, and another 1.5% in 2017,” Johnson explains.

A switch to a more appropriate index like the CPI-E to calculate the annual COLA could have a big impact on the adequacy of Social Security benefits over a 20 - to - 30 - year retirement, projections for TSCL indicate. According to a new projection by Johnson, people who retired in 2015 with average benefits of $1,355 would receive about $29,568 more in Social Security income over a twenty - five year period using the CPI-E. The difference compounds over time. By the end of the 25 - year period, Johnson estimates that monthly benefits would be 8.9% higher using the CPI-E. “And this is normally the time when retirees need it the most,” she says. “Financial resources are at their lowest and healthcare costs are at their highest,” Johnson adds.

According to a recent TSCL survey, 80 percent of older Americans support switching to the CPI-E to calculate COLAs. TSCL is lobbying for legislation that would provide a more fair COLA by tying the calculation to a seniors index like the CPI-E. To learn more and participate in TSCL surveys, visit www.SeniorsLeague.org.

###

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.