(Washington, DC) A new analysis from The Senior Citizens League takes a look at what the Social Security Trust Fund might collect in payroll tax revenues from just a few of the highest paid U.S. workers. “In a sampling of just 20 CEOs from the Fortune top 80 companies, the analysis found that total base salaries and performance pay not currently taxed for Social Security is expected to total $121.5 million in 2018, averaging more than $6 million per CEO sampled,” stated Mary Johnson, a Social Security policy analyst for The Senior Citizens League.

Under current law, employers withhold 6.2% in Social Security taxes from workers’ earnings — an amount that employers match for a total of 12.4%. That money goes to the U.S. Treasury and is used to pay benefits to today’s retirees. About 85 percent of all employees, pay Social Security taxes on every dollar earned.

But that’s not the case for about 12 million employees with the highest salaries in the country. Unlike the Medicare payroll tax, which applies to all earnings, Social Security payroll taxes apply only to the first $128,400 in earnings. Neither the employees who earn more than $128,400, nor their employers, pay Social Security taxes on earnings in excess of that amount. “That’s a problem for Social Security’s financing,” says Johnson.

In its June 2018 Long Term Budget Outlook, the Congressional Budget Office (CBO) projected that earnings will grow faster for higher-income people than for others over the next 30 years. The CBO expects that trend to lead to a decrease in the amount of payroll tax receipts that otherwise would flow into Social Security, as a greater share of earnings will be above the maximum amount subject to Social Security payroll taxes.

Johnson selected 20 companies for her sample and downloaded each company’s public 2018 proxy information, which contains Executive Compensation Tables required by the Security Exchange Commission. The analysis uses only the actual salary and performance pay, both of which are subject to Medicare and Social Security payroll taxes up to the limit. No stock awards were included.

Major findings:

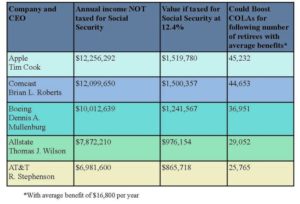

- Of the 20 CEOs, annual income not taxed for Social Security totaled $121,545,322 and averaged $6,077,266 per CEO.

- The revenues that would be collected based on the 12.4% Social Security tax (the total paid by employee with the employer match) was $15,071,619, and averaged $753,581 per CEO.

- The total revenues in the sample could pay the Social Security benefits of 897 retirees, with an average monthly benefit of $1,400, for an entire year. Or, that revenue could be used to provide a modest boost to the COLA of 448,560 retirees in the first year, by tying the annual inflation adjustment to the Consumer Price Index for the Elderly (CPI-E).

- The average CEO in the sample would pay enough Social Security revenues to cover the entire benefit of 45 retirees with an average benefit of $16,800 for a year, or, boost the COLA of 22,428 retirees with average benefits in the first year.

The following chart illustrates 5 examples:

“Our example just looked at the salaries and performance pay of just 20 CEOs,” notes Johnson. “According to the Social Security Administration, there will be 12 million people who earn above the taxable maximum in 2018,” she adds.

According to a recent survey by The Senior Citizens League, 74 percent of survey participants favor applying the 12.4% Social Security payroll tax to all earnings. To learn more, visit www.SeniorsLeague.org.

#

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.