(Washington, DC) The portion of Social Security benefits that retirees spent on Medicare premiums and out-of-pocket costs climbed in 2018 for a growing number of retirees in 2018, according to a recent survey by The Senior Citizens League. About 30 percent of retirees say that premiums and out-of-pocket spending consumed one-third to one-half of their Social Security benefits. The findings represent a 7 percent jump from the 23 percent of retirees reporting healthcare costs took this portion of Social Security in 2017.

“This increase is due in large part to the effects of a zero and an excessively low cost of living adjustment (COLA) in 2016 and 2017, occurring when Medicare premiums and out-of-pocket costs like prescription drugs were climbing steeply,” says Mary Johnson, a Social Security and Medicare policy analyst for The Senior Citizens League.

New retirees often fail to understand just how rising Medicare costs can result in less Social Security income than anticipated. The Social Security Administration automatically deducts premiums for Medicare Part B from Social Security benefits. This year, the Part B premium is $134.00 per month for retirees with incomes under $85,000 and the Medicare Trustees estimate it will rise to $135.50 for 2019.

A study on the buying power of Social Security benefits by Johnson has found that Medicare Part B premiums are the single fastest growing cost that retirees have, increasing 195 percent since 2000. Most retirees also have premiums for a Medicare supplement (Medigap) and Part D drug plan, or a Medicare Advantage health plan with drug coverage. Medigap premiums have increased 158 percent since 2000, and out-of-pocket spending on prescription drugs increased 188 percent.

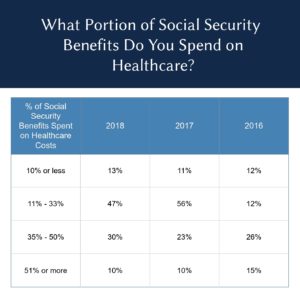

When asked what portion of Social Security benefits retirees spent on healthcare here’s how survey participants responded:

“Even though Medicare premiums and out-of-pocket drug costs are the fastest growing and biggest financial challenge in retirement, that growth is not accounted for in the annual COLA,” Johnson says. The consumer price index used to calculate the COLA for retirees reflects the spending pattern of young urban workers, and explicitly excludes people over the age 62. But younger workers don’t get Medicare, and spend a much lower portion of their incomes on healthcare.

“This is a major reason why Social Security checks don’t keep up with rising Medicare costs,” explains Johnson. “In fact, Social Security benefits have lost 34 percent of buying power since 2000,” Johnson adds.

The Senior Citizens League supports legislation that would strengthen the COLA and better protect the buying power of Social Security recipients. To learn more, visit www.SeniorsLeague.org.

#

With 1.2 million supporters, The Senior Citizens League is one of the nation’s largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.