Social Security benefit cuts are the top retirement concern of 58% of all participants in TSCL’s most recent Retirement Survey. There’s good reason to be worried. The new House Speaker, Representative Mike Johnson (LA-4), headed the Republican Study Committee (RSC) Budget & Spending Task Force that drafted a 2020 plan that would cut Social Security benefits.

Those Social Security benefit cuts include cutting the annual cost-of-living adjustment (COLA). According to the Task Force plan, “The formula uses an old index, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which overstates the true effects of inflation.” The plan says the outdated formula “contributes to the current program’s impending bankruptcy.”

But TSCL research on the COLA and the buying power of benefits indicates just the opposite is true — the CPI-W understates inflation. In fact, Social Security benefits have lost 36% of buying power from 2000 – 2023. Average benefits today would need to be $516 per month higher to maintain the same buying power as in 2000.

The RNC Task Force plan proposes ending the current system of providing COLA increases to all beneficiaries and instead would apply a new means test. Specifically, the proposal would eliminate the COLA entirely for individual retirees with incomes above $85,000 or $170,000 filing jointly.

Just as controversial, the RSC plan calls for an alternate method of computing the COLA by tying it to the chained Consumer Price Index for all Urban consumers, which grows even more slowly than the currently used Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Such a change can be expected to cut the purchasing power of the benefits of all retirees who continue to receive COLAs because the annual adjustment would grow more slowly.

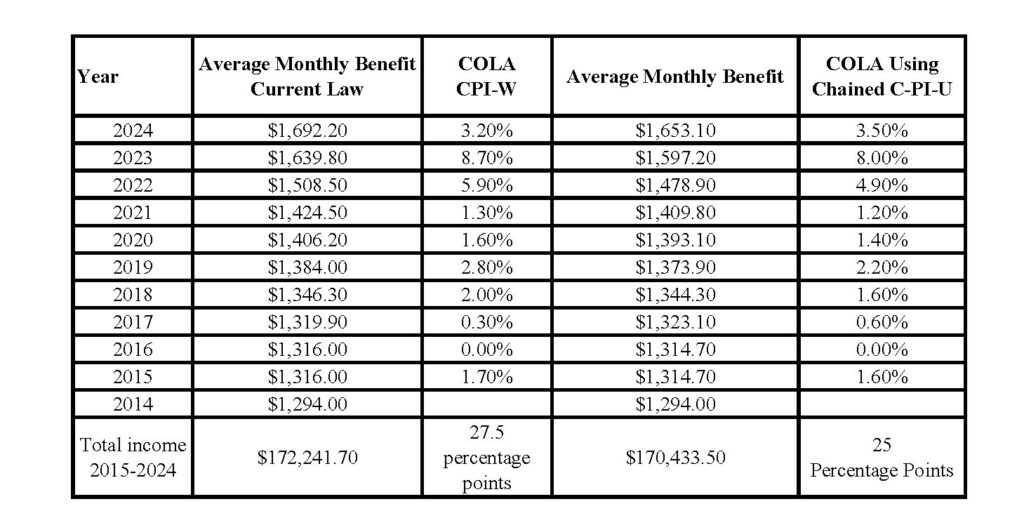

The following table illustrates this proposal's financial impact on those who continue to receive the COLA by comparing COLA increases from 2015 to 2024 with what those increases would have been if using the chained CPI instead. The analysis found that a starting monthly benefit of $1,294, the average in 2014, would be $1,692.20 in 2024. Had the chained CPI been used to calculate the annual increase, the monthly benefit would only be $1,653,10 in 2024 — about $39 per month less. Total Social Security income since 2015 would be about $1,808 lower.

How “Chaining the COLA” Would Cut Social Security Benefits

*Source: The Senior Citizens League

CPI-W: Consumer Price Index for Urban Wage Earners and Clerical Workers

C-CPI-U: Chained CPI for All Urban Consumers, based on initial inflation data through September 2023

What do you think of this proposal? Tell us! Please take TSCL’s 2024 Senior Survey _ https://seniorsleague.org/2024-senior-survey/

Food for thought:

Some policymakers try to belittle COLA cuts, saying, “It doesn’t amount to a hill of beans.” But $1,808 would buy at least 1,808 pounds of dried beans. A single pound of dried beans yields about 6 cups when cooked. That 1,808 pounds of dried beans would cook up to 10,848 cups — enough to provide two servings of beans a day for more than 29 years, about the entire length of a good long retirement. That’s some hill of beans!

Tell Congress NO Social Security cuts! Call toll-free here (844) 455-0045.