For Immediate Release:

September 11, 2024

With One Month Left, COLA for 2025 Forecast at 2.5%

According to The Senior Citizens League

The TSCL Social Security cost of living adjustment (COLA) model predicts that the COLA for 2025 will be 2.5%, based on a decline from 2.9% to 2.5% in consumer price data. A COLA of 2.5% would raise the average monthly benefit for retired workers of $1,920 by $48. The Social Security Administration is expected to announce the COLA for 2024 in mid-October.

While 2.5% is lower than the 3.2% received in 2024, that wouldn’t be far from the historical norm. The COLA has averaged about 2.6% over the past 20 years. It went as low as 0.0% in 2010, 2011, and 2016 and as high as 8.7% in 2023.

By law, the annual inflation adjustment is based on the average inflation during July, August, and September as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The Bureau of Labor Statistics averages the CPI-W for these three months and then compares it with the same time frame from the previous year. The percentage difference between the two is the COLA, payable for checks received in January 2025. The 2024 COLA computation can be found on the Social Security website.

Older Households Report Higher Spending Compared to 2023, Despite Financial Struggles

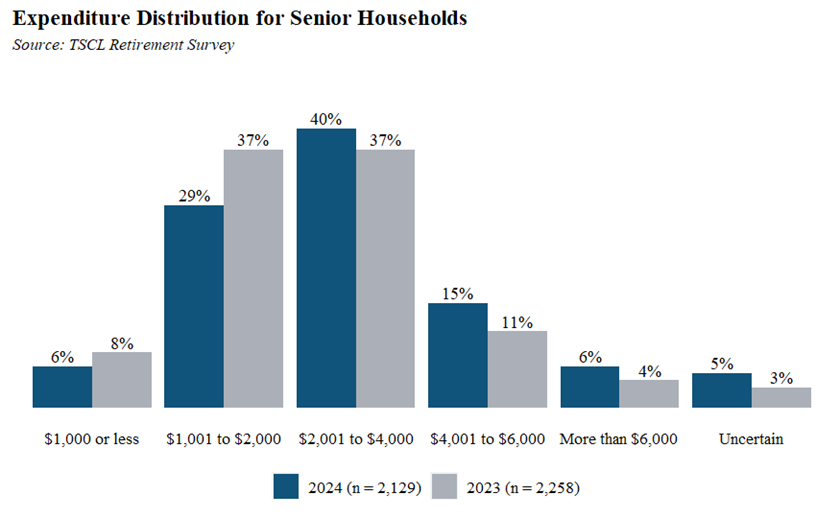

Due to a higher cost of living, older Americans are using more and more of their income each month just to get by compared to a year ago. In TSCL’s 2024 Retirement Survey, 65% of seniors reported monthly expenses of at least $2,000, up from 55% in 2023. Statistical testing shows that there’s almost no chance that this gap is due to noisy survey variation. (The 2024 survey had 2,129 respondents; 2023 had 2,258 respondents.)

Low-income seniors aren’t the only ones who have seen their expenses rise, either. As shown in the chart below, more seniors are spending at least $4,000 or $6,000 per month compared to 2023, too, while fewer are able to get by on $1,000 or less. These differences were also statistically meaningful.

A rise in monthly expenses wouldn’t be much of an issue if seniors’ higher expenses were going to fun activities things, like activities with their grandchildren, or discretionary costs, like bucket-list vacations. However, that’s not the case. Nearly 80% of senior households in the 2024 survey reported that their monthly budget for essential items like food, housing, and prescription drugs had increased over the last 12 months, with 63 % saying they’re worried that their income won’t be enough to cover these basic costs in the coming months.

“Ensuring that seniors have enough to feed and house themselves with dignity is a major reason why we advocate for a minimum COLA of 3%,” says Shannon Benton, TSCL’s Executive Director. “TSCL research shows that approximately two-thirds of seniors rely on Social Security for more than half of their monthly income, and 28% depend on it entirely.”