For Immediate Release:

July 18, 2024

Social Security Benefits Lose 20% Of Buying Power Since 2010

According to The Senior Citizens League

Research on the buying power of Social Security benefits by The Senior Citizens League (TSCL) shows that the value of seniors’ benefits has declined by 20 percent since 2010. The 2024 Loss of Buying Power study found that, on average, payments for retired workers would need to rise by $4,440 per year or $370 per month, to rebuild their lost value.

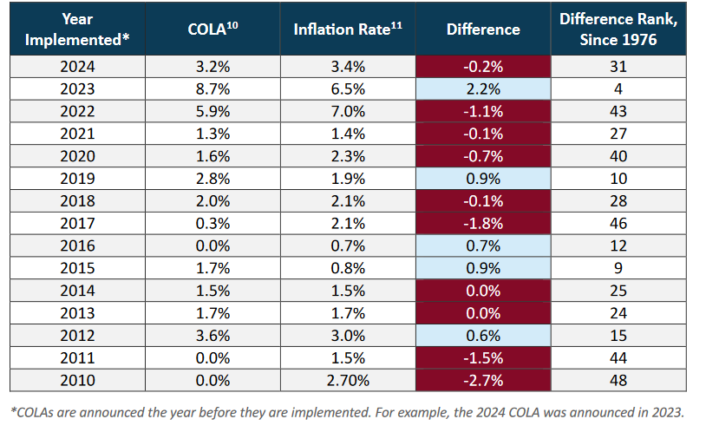

The Average Social Security Benefit Has Lost 20% of Its Value Since 2010

Average monthly Social Security payment for retired workers.

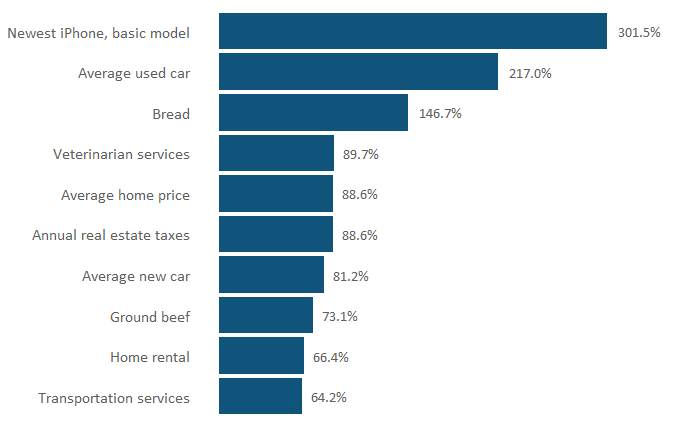

The study confirms that prices older consumers are paying have outstripped cost-of-living adjustments (COLAs), leaving many on the edge of financial distress. For example, consider the COLA of 5.9 percent implemented in 2022. While the raw value was historically high, inflation came in 1.1 percentage points higher, at 7.0 percent, according to the Consumer Price Index (CPI). This trend has repeated all too often since the start of the 2010s: Eight of the last fifteen COLAs have failed to surpass inflation for the year in which they were implemented, with five of these COLAs ranking in the bottom ten since 1976 in terms of their strength relative to inflation. (1976 was the first year that the government used the CPI to determine the COLA).

Inflation Outpaced COLAs Eight Times in the Last 15 Years

Difference between COLAs and Inflation since 2010

The reality is that COLAs have become less and less likely to match inflation over time. In the 1990s and 2000s, 60 percent of COLAs beat inflation. In the 2010s, only 40 percent did. Through the 2020s so far, only one COLA out of five (2023; 8.7 percent) has done so.

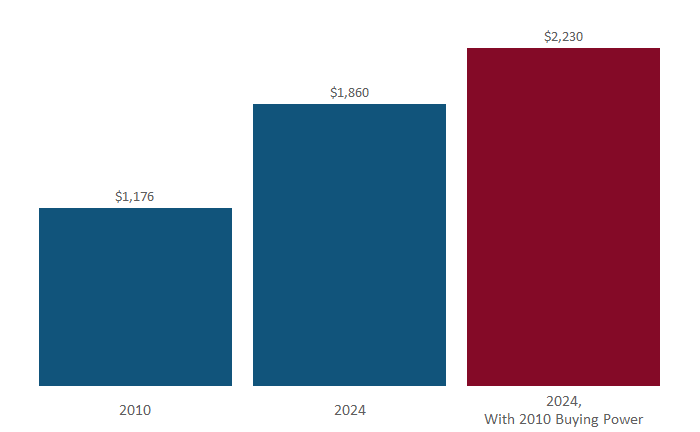

Fast-rising costs for big-ticket items are the biggest culprit. The cost of the average iPhone—a necessity for today’s seniors—has increased by more than 300 percent since 2010, while the price of the average used car has more than doubled. Housing, in particular, puts extreme financial stress on seniors. The cost of an average home and real estate taxes in the United States have risen by 89 percent since 2010, and according to the CPI for the Elderly (CPI-E), a price index the Bureau of Labor Statistics uses to reflect how seniors divide their expenses, housing makes up nearly half of the typical senior budget.

Smartphones, Vehicles, and Housing Saw Exorbitant Rises

Top 10 Loss of Buying Power index items by percent cost increase, 2010-2024

Without an accurate cost-of-living adjustment (COLA) that keeps pace with rising costs, beneficiaries lose purchasing power, especially over the course of a retirement that could last 25 to 30 years. This loss is cumulative and grows deeper as retirees age. It can cause substantial hardships, including more rapid depletion of savings than expected, growing debt, and worse health outcomes. In short, a meaningful deterioration in an older household’s standard of living,

Between 2010 and 2024, Social Security COLAs increased benefits by 58 percent, averaging 3.9 percent per year. However, the cost of goods and services purchased by typical retirees rose by 73 percent, averaging about 4.9 percent annually over the same period. For every $100 a retired household spent on groceries in 2010, that household can only buy about $80 worth today.

What’s worse, Social Security’s poor financial health spells even deeper cuts to buying power in the future. According to the Social Security Administration’s (SSA’s) Chief Actuary, Social Security is on track to become insolvent in 2033 and, consequently, see benefits cut by 23 percent. This means that people who are already retired could see a dramatic drop in living standards, while those who will retire soon will never see the value they contributed to the program if Congress fails to act.

That’s why this upcoming election is so important! TSCL is a non-partisan organization and does not endorse any political party, but it’s critical to support candidates who value their senior constituents. We strongly encourage you to research your choices for the House of Representatives and Senate and vote for those who plan to address Social Security’s buying power while strengthening the program’s financial health for the future.