Q: When is the Social Security Trust Fund estimated to go bankrupt, and would the 5.9% COLA cause it to be depleted sooner than forecast?

A: Last August, the Social Security Trustees released the 2021 annual report, estimating that the combined Social Security Retirement and Survivors Trust Fund, as well as the Disability Insurance Trust Fund, will be depleted by 2034. That wasn’t a new estimate, however. While it was one year earlier than the trustees had forecast in April of 2020, the Social Security Actuaries adjusted their forecast in November of 2020 to account for the impacts of COVID-19 on Trust Fund solvency. At that time, the actuaries moved the insolvency date forward one year from 2035 to 2034.

Q: Is the change insolvency date a big change?

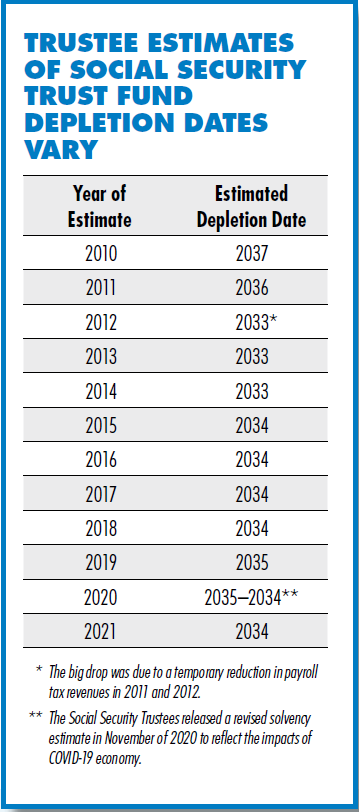

A: We don’t think so. In the past, the Trustees have estimated the insolvency date could be even sooner than 2034. Since 2010, Trustee estimates of the Social Security Trust Fund depletion date have ranged from as late as 2037, to as soon as 2033, and that was just during a three-year period. The table below illustrates:

Q: Would the 5.9% COLA worsen that forecast?

A: Not by much. First of all, both the Social Security Trustees, and the Congressional Budget Office, tend to overestimate the rate of inflation and the COLA, at around 2.2% to 2.8% in their budget projections. From 2010 to 2021 however, COLAs averaged just 1.4%, and that low inflation may have added some solvency to the program. The Centers for Retirement Research at Boston College has estimated that the 5.9% COLA would erode trust fund solvency by only two months.

Let us know what you think. Please take our 2022 Senior Survey: www.SeniorsLeague.org/2022survey.