By Mary Johnson, editor

Judging by my email, many of you are living in a manner that you’re unaccustomed to — and not in a good way. Since 2021, higher prices on everyday essentials like housing, heating, food, and prescription medication, has almost everyone anxious about where the money will come from to pay all the bills.

C.A. of Michigan expresses it well:

There has been much done for families to pull them out of poverty and rightly so, but what about seniors living in poverty? Medicare rates are going up $21 a month and the cost-of-living adjustments comes nowhere near to making up for years of low increases. My check is $955 a month.

I will always have to work to afford to live. Seniors were promised to be brought out of poverty and those of us at the lower end promised an increase. Seniors deserve better. High drug costs, housing costs, insurance costs, food costs. Why are we always left behind?

Thank you for continuing to advocate for the seniors.

According to the Social Security Administration, today’s 65-year-olds can expect to spend another 20 years in retirement, but how can we afford our retirement when prices spiral into outer space? Here’s an important fact to keep in mind: while the price inflation we are witnessing today is the highest seen in 4 decades, and may last into part of this year, it won’t last forever. At some point price increases will start moderating and might even start coming down. In fact, after a period of high inflation, deflation can occur. Demand for goods weakens, and prices could eventually come down as companies lower prices and start competing more for business.

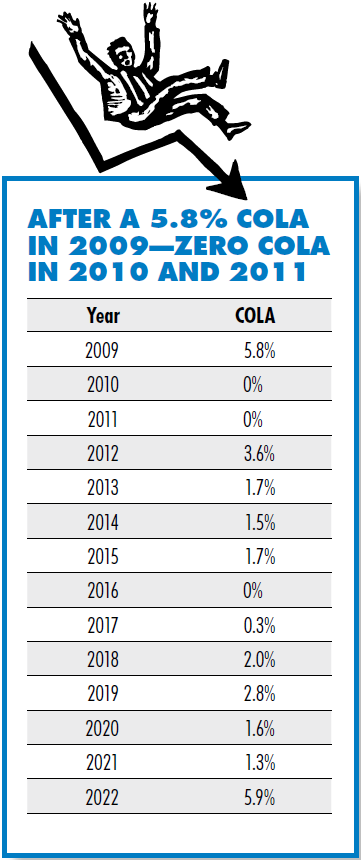

Deflation comes with its own set of anxiety-causing problems. Rapid deflation could cause prices to dip so low that no cost-of-living adjustment (COLA) would be payable at all. This happened in 2009 when a 5.8% COLA became effective. Deflation was so low that, in both 2010 and 2011, no COLA was payable. But at the same time, Medicare Part B premiums climbed by 14.6% and 4.2% respectively. The following table illustrates COLA increases since 2009. Take a look at the years when the COLA was highest — 2009, 2012 and 2019 — and notice how the COLA was significantly lower or even completely non-existent, in the following year, signifying a drop in the rate of inflation.

What are the chances of inflation dropping to zero? It’s still too early to say if inflation is done with us yet. As of inflation through November 2021, inflation is still rising, up by 6.8%. But whether we face fierce inflation or the problems of deflation and low COLAs, more than 62 million people depend on Social Security and need their annual COLA to do a better job of keeping pace with prices experienced by retired and disabled Americans.

What can you do to help change the situation? Your opinion matters and it can change votes in Congress. Please take our 2022 Senior Survey at www.SeniorsLeague.org/2022survey.