The term “Notch” refers to the disparity in Social Security benefits paid to people born from 1917 through 1926 and those paid to people born before and after them with similar work/earnings records. Many of those born during the Notch period feel they have not been treated fairly and are not receiving the benefits that Congress intended. On the other hand, the Social Security Administration (SSA), some government officials, and the AARP (formerly the American Association of Retired Persons) say that those born during the Notch period are treated fairly and receiving the benefits that Congress intended. The SSA and the AARP say that Social Security does not promise a specific amount of benefits, rather Social Security is designed to replace a certain percentage of pre-retirement earnings. Who is correct?

In 1977 Social Security was going bankrupt because of a flawed benefit formula that raised benefits too quickly. That year Congress passed legislation which changed the way benefits were calculated starting with retirees who were born in 1917 and became eligible for benefits in 1979. The changes were major and the transition between the old and new method of calculating benefits did not work as anticipated.

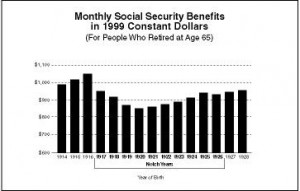

The period covered by the Notch is a major area of dispute. When benefits are represented on a chart, the disparity forms a deep “V” notch. Benefits plunged from a peak for retirees born in 1916 and hit the lowest part of the “V” for those who were born in the years 1920-21. Benefits began to rise for those born in 1922 until they became level with other retirees, starting with those born in 1927. See illustration below.

Source: Congressional Research Service May 24, 1999

The SSA and the AARP say, however, the Notch affects only those born during the five-year period of 1917 through 1921. Those born during that period were covered by a special transitional benefit formula, the purpose of which was to provide a 5-year phase-in for the new 1977 benefit formula.

In making the 1977 changes, Congress, wanting to avoid an abrupt change, allowed persons born from 1917 through 1921 to use a special transitional benefit formula or the new 1977 formula, whichever would yield the higher of the two benefits. The transition benefit formula never delivered the promised benefit protection, however, because it did not yield a higher benefit amount. Instead, the new benefit formula most often yielded the higher amount.

Thus the new formula went into effect almost immediately for most people and is one reason why retirees born over the ten-year period of 1917 through 1926 were affected, not only those covered by the five-year phase-in. In addition, the economy did not perform the way Congress and the Social Security Administration assumed it would under the new benefit formula. Slower than anticipated wage growth, and higher than expected price inflation, resulted in even greater benefit reductions than under original assumptions. These economic conditions persisted for a decade, thus affecting those born over a ten-year period.

According to the Congressional Research Service (CRS), for an age 65 retiree with average wages, a maximum benefit disparity of 10% would have arisen between the highest benefit under the old rules and the lowest benefit under the new rules if the 1977 assumptions had materialized. Under the economic conditions that actually arose, the disparity was 25%-two and one half times greater.

Indeed, the Social Security Administration does not “promise” a specific amount of benefits, but they do not promise to replace a specific percentage of pre-retirement earnings either. Both benefit amounts and “replacement rates” can change at any time if Congress and the Social Security Administration deem it necessary. Prior to the 1977 changes, the replacement rate was not a stable percentage. For people who retired under the 1972-73 flawed formula (those born 1913 through 1916), replacement rates grew from 39% to a high of 54%. The new benefit formula led to a lower, more stable replacement rate of about 43%, as well as lower benefits.

For those planning retirement however, it is the estimated dollar amount in Social Security benefits, not the replacement rate, that what one uses to determine a retirement budget, or how much more one will need to save for retirement. When one retires, it is the actual benefit amount, not the replacement rate that one must live on. One of the most frequent requests for services received by Social Security Administration is for an estimate of benefits. While no promises of benefits are made, millions of estimates are made annually. If the rules are changed abruptly, as they were for those born during the Notch period, this leaves no time to save for the shortfalls in benefits (if they can be foreseen ahead of time).

Both the SSA and AARP say that “fixing” the Notch would be a costly mistake that would drain dollars from the Social Security Trust Fund reserve. In 1992 one popular piece of legislation to provide improved monthly benefits was estimated to cost $300 billion. To counter these concerns, alternative “capped-cost” legislation has been introduced. “The Notch Fairness Act of 2001” would provide those born from 1917 through 1926 their choice of either improved monthly benefits, or a Lump-Sum of $5,000 payable over a four-year period. The cost of Lump-Sum legislation is estimated to be $45 billion, or slightly less than $11.25 billion per year over a four-year period.

The $45 billion could be financed without taking money from the Social Security Trust Fund. One way is through reduction of pork barrel spending and government waste. In the fiscal year 2001 budget alone, pork “watch-dog” Senator John McCain (AZ-R) estimated that the government would spend a record $50 billion in pork-barrel projects.

In addition, since 1992 there has been a significant change to the government’s bottom line. For the government fiscal year ending September 30, 2000, the Congressional Budget Office (CBO) reported a surplus of $236 billion-$86 billion of which comes from non Social Security revenues. The CBO estimates the 10-year non-Social Security surplus to be about $3.1 trillion.

Those born during the Notch period “saved Social Security” by receiving lower benefits for the rest of their lives. They are the generation that fought and sacrificed during World War II. Now, although they receive lower benefits, they are among the senior age group hit hardest by escalating health care insurance premiums and prescription drug costs.

TREA Senior Citizens League (TSCL) was formed in 1993 to protect “earned” Social Security and Medicare benefits. Many TSCL members are affected by the Notch, and rank Notch Reform as their top legislative priority. TSCL is the only national senior citizens action organization to continue to lobby for Notch Reform. To date, TSCL has 1.3 million members and supporters who participate in a number of grassroots lobbying and public education campaigns.

Article I of the United States Bill of Rights guarantees citizens the right to petition the government for “redress” of grievances. Individuals build greater political clout when they join forces with other like-minded activists to press for change. Time is running out for Notch Babies. TSCL members and their families, friends, and supporters will not allow the Notch Issue to quietly die away, but will continue to press for compensating those born during the Notch period as long as they set that as their number one legislative goal.

TSCL is registered as a 501(c)(4) citizens action organization. Open to anyone concerned about protecting earned benefits, TSCL is registered to conduct grass roots lobbying, public education, and fundraising activities in nearly every state. No government moneys are accepted or utilized by TSCL.

For more information:

TREA Senior Citizens League

1001 N. Fairfax Street

Suite 101

Alexandria, VA 22314

1-800-333-8725

www.SeniorsLeague.org

March 2001